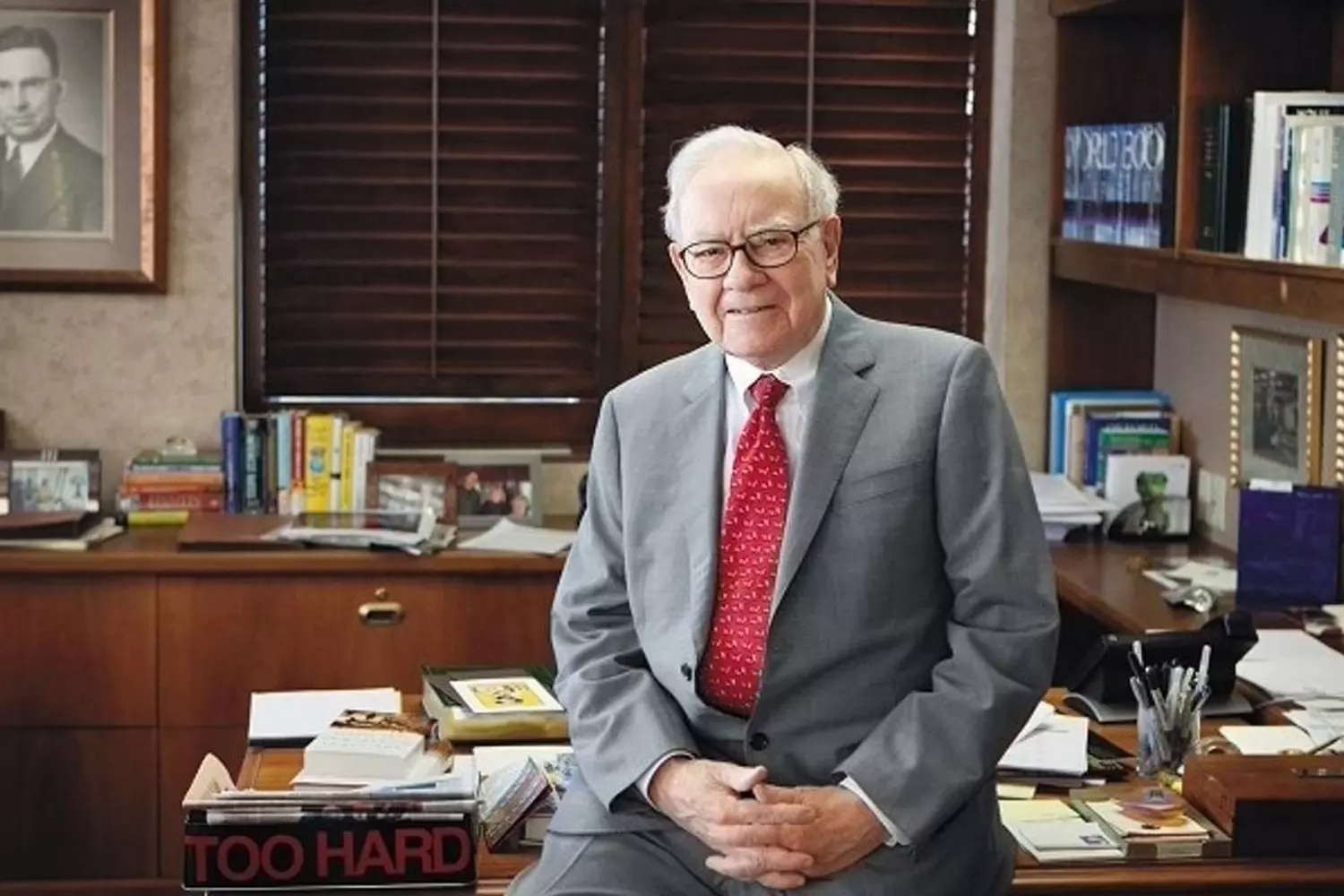

Warren Buffett is not just a name. It’s a phenomenon. A brand that needs no advertising. A voice of reason in a world ruled by panic and speculation. A man who became a billionaire by following common sense, not trends. And perhaps that is his greatest miracle.

In a world where investors chase hype and markets move to the rhythm of noise, Warren Buffett has shown for decades that patience and discipline are not outdated. He speaks simply and clearly, as if he’s not managing billions, but giving advice to his nephew in the kitchen. And it’s precisely in this simplicity that his strength lies. He didn’t sell air, juggle fancy words, or seek easy ways out. He bought what he understood. And he won where others lost.

It’s hard to believe, but the man managing tens of billions of dollars still lives in the house he bought in 1958. He eats simple food, doesn’t wear designer suits, doesn’t fly private jets just for the sake of it, and doesn’t spend money on expensive toys. And yet — he is one of the richest people on the planet. A contradiction? No. Just philosophy. Both in life and investing.

Behind him are more than 70 years of experience, hundreds of companies in his portfolio, millions of followers. Presidents quote him, traders discuss his moves, and business schools study his lessons. He has long become a part of America’s economic culture — and beyond. But if you dig deeper, it becomes clear: behind all the numbers, deals, and reports, there is a person. With his fears, beliefs, and habits. A person who once sold chewing gum to neighbors as a child, and today runs Berkshire Hathaway — one of the largest holdings in the world.

This article is not just a biography. It’s an attempt to understand why Warren Buffett became Warren Buffett. What makes him unique? Why do his principles work? And what can we learn from him, even if we don’t invest millions?

Dive into a life story that proves: it’s possible to be successful and honest at the same time. To be wealthy — and not lose your humanity. To be a legend — and remain yourself.

“If you’re not willing to hold a stock for 10 years, don’t even think about holding it for 10 minutes.” — Warren Buffett

How It All Began: The Early Years of Warren Buffett, the Boy with a Finance Mind

If someone had said in the 1930s that a modest boy from Omaha, Nebraska, would become the greatest investor in history, they probably wouldn’t have been taken seriously. But Warren Edward Buffett, born on August 30, 1930, was different from the start. His ability to see money where others saw only small change appeared long before his first stock purchase.

- 01. Childhood marked by the Great Depression

Buffett was born during a difficult time: the Great Depression was destroying the U.S. economy, millions of people were losing jobs, confidence, and homes. His father, Howard Buffett, was a broker and later a congressman. The family wasn’t wealthy, but they didn’t suffer poverty either. Warren grew up in an atmosphere of strict financial calculation, where every dollar mattered, and every action was judged by its usefulness.

“Even as a child, I knew: if I spend a dollar, it will never work for me again,” Buffett recalled.

From an early age, he was interested in numbers, books, accounts, and statistics. While other kids played baseball, Warren read reports on soda prices and memorized which neighborhoods drank more Coca-Cola. - 02. First money — from newspapers and chewing gum

Warren started earning money before his teens. He bought Wrigley’s chewing gum wholesale and resold it piece by piece. Then he switched to selling Coca-Cola bottles to neighbors for 5 cents each — with a markup. He kept records, calculated margins, and analyzed profits. He was only 7 years old.

Soon after, he became a newspaper delivery boy. Getting up early, riding his bike, delivering morning editions of The Washington Post and The Omaha World-Herald. He earned a few dollars a day, and by age 13 had already filed an income tax return with the IRS — proudly deducting $35 for a bicycle “necessary for work.” - 03. First business: vending machines and pinball

Warren didn’t just save money — he created assets. Together with a friend, he bought a pinball machine for $25 and placed it in a local barber shop. Within weeks, the profit allowed them to buy a second machine, then a third within a month. Eventually, they sold the entire business for $1,200 — a huge sum for a teenager at the time. According to Buffett, this was a turning point: he realized he wanted money to work for him, not the other way around. - 04. A schoolboy with financial thinking

Warren attended school like any other child but thought like an adult. He read biographies of businessmen, devoured company statistics, studied accounting books and… started trading stocks at age 11. Yes, that’s when he bought his first three shares of Cities Service at $38 each. The price soon dropped to $27 — Buffett worried but didn’t sell. When it rose to $40, he gave in and sold… only to watch the price climb to $200.

This experience taught him one of life’s most important lessons — patience. He regretted his haste and learned that the market dislikes rush. - 05. Young arbitrageur

By age 15, Warren had several income streams, from vending machines to agricultural investments. He even bought racehorses with a friend to lease them at the racetrack. Everything followed the principle: invest, calculate, optimize, extract.

By then, he knew for sure he wanted to spend his life in investing. He didn’t dream of being a firefighter or a baseball player. He dreamed of numbers, deals, and profits.

The early years of Warren Buffett are not just a timeline of events. It’s a story of a mindset that worked differently from childhood. A story about a boy who wasn’t afraid of responsibility, wasn’t lazy about calculating, and could see the future behind every small sale. It was then that the foundation was laid for who he would become later: the most rational billionaire in the world.

“The Magic of Compound Interest”: How Warren Buffett Built an Investment Empire

After a brilliant start in childhood, Warren Buffett never slowed down—not even for a minute. His youthful interest in money transformed into something greater — the art of long-term investing. Every year, he proved that resilience, discipline, and logic can overcome any market hysteria. Neither crises, the dot-com bubble, nor pandemics shook his philosophy. On the contrary — they made it even more relevant.

- 01. An education that didn’t fit the standards

After finishing school, Buffett enrolled at the University of Pennsylvania, then transferred to the University of Nebraska, graduating at 19. He wanted not just knowledge but practical skills. He wanted to go to Harvard but... wasn’t accepted. Perhaps the best “no” of his life.

He found the place that taught what he needed: Columbia University, where his idol — Benjamin Graham, author of the legendary book The Intelligent Investor — taught. Graham introduced Buffett to the concept of “margin of safety” — investing only when an asset is priced below its intrinsic value. This principle became his lifelong foundation. - 02. First steps in real business

After graduating, Buffett joined his mentor’s company — Graham-Newman Corp. There he learned to evaluate companies, dig into financial reports, and find what the market overlooked. Soon Graham retired, and Buffett returned to Omaha, where in 1956 he opened his first investment partnership — Buffett Partnership Ltd. (BPL). What did he do?

He raised money from friends, relatives, and small investors. He didn’t charge management fees but took a percentage of profits above a certain threshold. Buffett invested alongside clients in the same assets — sharing the risk fully. By the early 1960s, the partnership was growing rapidly. He found undervalued companies, sometimes troubled but with good potential. He didn’t believe in market “hot topics” — only in business as a value-generating machine. - 03. Acquiring Berkshire Hathaway

In 1962, Buffett began buying shares of the struggling textile company Berkshire Hathaway. Why? He believed the company was worth less than its liquidation value. In 1965, he gained control and realized textile was a dying business.

But instead of selling Berkshire, he turned it into a holding company. Through it, he began acquiring stakes in other businesses, initially insurance companies (such as GEICO, which he admired since youth), then banks, energy, transportation, and FMCG sectors.

Thus was born a financial empire where Buffett could buy and hold businesses forever. Not trading prices, but participating in profits and growth. - 04. Investments that became legendary

Here are just a few of Buffett’s iconic investments:

- Coca-Cola

In 1988, Berkshire acquired 6.3% of the company for $1.3 billion. As of the 2020s, this yields over $600 million in dividends annually. - American Express

After the fraud crisis in the 1960s, Buffett believed in the brand and invested when the stock was at its lowest. The company became one of the most profitable in his portfolio. - Apple

Buffett long ignored tech but bought Apple shares in 2016 — now Berkshire’s largest holding (over $150 billion). - BNSF Railway

The full acquisition of the railroad company was Buffett’s largest purchase ($44 billion).

He avoided investing in bitcoin, startups, and anything without measurable intrinsic value. In his world, there’s no place for “FOMO” — only fundamental analysis.

- 05. Buffett in the 21st century: age is no barrier to billions

Even in his 90s, Buffett goes to his Omaha office daily, drinks Cherry Coke, and reads 500 pages of reports. He admits mistakes openly: once admitting he regretted buying airline stocks before the pandemic. He sold, took the loss — and moved on.

Buffett’s net worth is currently estimated at about $130 billion. He ranks among the top three richest people on the planet. His annual letters to Berkshire Hathaway shareholders are studied by millions of investors — regarded as a bible of common sense.

He still lives in the same Omaha house he bought in 1958. He eats at McDonald's, drinks Coca-Cola, drives an ordinary car, and says he doesn’t feel old. Because he hasn’t worked a single day in his life — he’s always done what he loves.

Buffett’s story is not only about wealth. It’s proof that ethics, patience, and reason can be even more profitable than risky moves. He built an empire but stayed grounded. He’s a billionaire who remains human. And that is his greatest legacy.

Warren Buffett’s Personal Wealth: Family, Relationships, and That Very “Simplicity”

Usually, when people talk about Warren Buffett, the focus shifts toward his financial genius, investment discipline, and phenomenal intuition. But behind the facade of the "Oracle of Omaha" lies an equally interesting and complex personal life. His journey as a husband, father, and friend is perhaps the least studied but no less significant part of the billionaire’s portrait. And, like his investments, it is full of surprises, paradoxes, and... humanity.

- 01. First marriage: with the woman who understood him best

In 1952, Warren Buffett married Susan Thompson — a bright, independent woman with a creative mind and strong convictions. Their relationship was built not only on love but also on mutual understanding, respect for each other's freedom, and an almost philosophical approach to life.

Susan played an important role in shaping Buffett’s views: she helped him open up, supported him through difficult times, influenced his political views and charitable initiatives. Although she preferred to stay in the background, her influence was felt in everything — from lifestyle to the character of his investments. - 02. An unconventional marriage model

Their marriage was not traditional in the classical sense. In 1977, Susan moved to live separately in San Francisco to pursue music and activism. But they never divorced. They continued to communicate, call each other every day, wrote letters, and spent holidays together.

It was Susan who, in 1978, introduced Warren to Astrid Menks, a waitress at a café whom she asked to take care of her husband. Astrid and Warren indeed became friends and later partners — but formally he remained married to Susan until her death in 2004. After Susan’s passing, Astrid became his life companion, and two years later they officially married.

This “triangle” did not cause scandals — on the contrary, it only emphasized the emotional maturity of all involved. It was a union not for show but based on mutual consent, friendship, and respect. - 03. The Buffett children: billions not inherited by default

Warren and Susan raised three children: Susan, Howard, and Peter. Despite their enormous wealth, Buffett never sought to make them heirs by default.

He didn’t buy them expensive cars as teenagers, nor spoil them with mansions or private jets. He believed the key was to give children “enough to do anything they want, but not so much that they wouldn’t want to do anything.”

- Howard Buffett took up farming and philanthropy and manages his own foundation.

- Peter Buffett became a composer, wrote music for series and documentaries, and published a book about how to be a billionaire’s son and still stay true to yourself.

- Susan Jr. works in politics and social projects, known for her outspoken stance on equality and human rights issues.

- 04. The billionaire’s lifestyle: home, food, habits

Warren Buffett has lived in the same house in Omaha since 1958. He bought it for $31,500 and has never moved since. The house is modest by wealthy standards — a cozy cottage surrounded by greenery, without security, tall fences, or even a swimming pool. This is not a pose — it is his genuine life philosophy.

He doesn’t wear designer clothes, doesn’t use a smartphone, doesn’t fly private jets unless necessary, and prefers to have breakfast at McDonald's. Yet, by his own account, he is happy.

Buffett doesn’t drink alcohol or exercise but has always valued reasonable moderation and mental hygiene. His main habit is reading: 5–6 hours a day. Newspapers, reports, books — he considers reading his superpower. - 05. Hobbies and friends

Buffett loves music. His favorite artist is Elvis Presley. He even sang with a guitar at home gatherings. Additionally, he is a fan of bridge — the intellectual card game he plays about 12 hours a week. Often — with Bill Gates, with whom he shares not only friendship but also joint charitable work.

He is also a big baseball fan — comparing it to investing: "Wait for your pitch. You don’t have to swing at every ball." - 06. The billionaire’s emotional intelligence

What sets Buffett apart from other billionaires? His remarkable emotional maturity. He knows how to listen, admit mistakes, and is not afraid to be vulnerable. He does not isolate himself from the world but instead tries to influence it positively.

Everything he does in business, politics, or personal life is guided by one key principle — to be useful and remain honest. This is not a slogan but a way of life that he has adhered to even in the most difficult situations.

Warren Buffett’s personal life is not a story of extravagance and glamour. It is a story of loyalty, humanity, modesty, and the freedom to be oneself. His family, relationships, and lifestyle strikingly contrast with his fortune, but that is where his true strength lies: resisting temptations when you have everything and choosing simplicity, sincerity, and meaning.

![Warren Buffett and His Wife: The Love Story Behind the Billionaire Investor Warren Buffett smiling with his wife [Susan/name if known], showing their genuine connection and partnership that lasted decades](https://americanbutler.ru/storage/app/media/useful/persons/warren-buffett/warren-buffett-04.webp)

Buffett’s Philosophy: Invest Wisely, Not by Luck

Warren Buffett didn’t just make money — he changed the very philosophy of how we relate to money. While most investors on Wall Street were chasing hype, rumors, and short-term profits, he was creating a timeless strategy based on common sense, understanding of business, and… the ability to wait.

- 01. Simplicity as a strategic advantage

Buffett always emphasized that to become a successful investor, you don’t need to be a genius, mathematician, or fortune teller. You need to know the limits of your competence and be honest with yourself. This is the foundation of Buffett’s philosophy: buy a business, not just stocks. - 02. Buffett’s equation for success

Investment = Understanding the business + Long-term advantages + Fair price

Let’s break it down:

- Understanding the business

If you can’t explain in 30 seconds what the company does and how it makes money — don’t invest. Buffett avoided tech stocks until he understood Apple’s model. - Sustainable advantage

The company must have what Buffett called an "economic moat" — this could be a brand, patents, a network, economies of scale, or customer loyalty. Coca-Cola, for example, became a global brand not because of the recipe, but because of consumer mindset. - Fair price

Buffett doesn’t hunt for the cheapest stocks. He looks for quality companies at reasonable prices, not mediocre assets on discount.

- 03. The “greatest lesson”: patience and logic

Early in his career, Buffett followed the strict “Graham” school — buying deeply undervalued assets regardless of business quality. But over time, he came to an important realization: it’s better to own an excellent company at a good price than a mediocre one at a bargain. This became his “greatest lesson” and fundamentally changed his approach.

According to Buffett, patience is what turns investing into an art rather than a gamble. He can hold stocks for decades if the business keeps growing. - 04. Berkshire Hathaway: a textile company turned empire

Few know that Berkshire Hathaway originally was a losing textile mill in New England. In 1962, Buffett began buying its shares because they cost less than the liquidation value.

Within a few years, he gained control. However, the textile industry was in decline. Instead of saving a sinking business, Buffett used Berkshire as a “wrapper” for other deals. He began buying good companies with stable cash flow through it:

- GEICO — an insurance company that impressed Buffett since his youth;

- Coca-Cola — his favorite consumer brand, in which he invested over $1 billion;

- BNSF Railway — the largest railroad company in the US;

- See’s Candies, Dairy Queen, Duracell, Fruit of the Loom, American Express, Bank of America, Apple — and dozens more.

This is how Berkshire Hathaway became not a stock holding company, but a business holding — a true value-creation machine.

Buffett’s model in action

- Financial independence

Berkshire Hathaway doesn’t pay dividends because Buffett believes he can reinvest capital more efficiently than any investor. - Long-term faith in America

He believes the American economy is the best platform for creating wealth. His strategy is for decades, not quarters. - Hands-off management

Buffett buys businesses, trusts management, and doesn’t interfere in operations. He invests in people, not just reports.

This approach made him not only the richest man but also one of the most respected in the world.

Buffett shows that being a smart investor means being a sensible person.

Buffett’s Portfolio: Who the World’s Most Rational Investor Trusts

Warren Buffett is not the kind of person who jumps from one hype to another. His investments are a belief in long-term value, deep analysis, and ironclad patience. The companies he invests in don’t just generate profit — they reflect his philosophy. Buffett doesn’t buy what’s trendy. He buys what’s reliable. And if he invests in a company, it means he believes in it not for a year, but for decades.

Let’s break down the key holdings in his investment portfolio and understand why they earned his trust.

- 01. Apple: technology turned into a consumer habit

Possibly one of Buffett’s most surprising investments. For a long time, he avoided tech companies, considering them too unpredictable. But in 2016, Berkshire Hathaway began buying Apple shares — and since then it has become the largest position in the portfolio (estimated to be over 40% of all shares). Why did Buffett “allow himself” Apple?

- He realized it’s not just an IT company. It’s a “brand-ecosystem” integrated into the lives of hundreds of millions of people.

- Apple generates enormous cash flows, has a loyal audience, and a unique ability to retain customers.

- The sales model of iPhone, iPad, subscriptions, and services makes the business predictable and stable.

“For consumers, the iPhone isn’t just a gadget. It’s their third pocket, an extension of themselves,” Buffett said in an interview. He not only holds onto his Apple shares but buys more when prices drop. This perfectly illustrates his principle: “If you believe in the business — own it, don’t trade it.”

- 02. Coca‑Cola: the taste of success and stability

Buffett has a special relationship with Coca‑Cola. He invested in the company back in 1988 — after the “Black Monday” crash, when the market fell and stock prices plummeted. But Buffett didn’t panic. He saw what others missed: Coca‑Cola is not just a beverage, but a global brand resilient to any crisis.

At that time, Berkshire Hathaway acquired about 6% of the company for $1.3 billion. Today, that stake brings in over $600 million in dividends annually, not counting the rise in stock value.

Buffett drinks several cans of Cherry Coke daily and has never hidden his personal attachment to the brand. He didn’t just invest in Coca‑Cola — he became part of it. Why did he choose it?

- Massive brand recognition worldwide.

- Low production costs and high profitability.

- Product and geographic diversification.

- Resilience to economic shocks: people don’t give up Coca‑Cola even in crises.

- 03.Bank of America: a financial giant in reliable hands

Buffett has long favored the financial sector. He believes in the US banking system’s structure, its risk resilience, and potential profitability with sound management. In this context, Bank of America is one of Berkshire Hathaway’s key bets. Berkshire owns over 1 billion shares of Bank of America, making Buffett its largest shareholder. He began actively buying shares after the 2008 financial crisis, when most investors fled the banking sector like fire. Why Bank of America?

- One of the largest banks in the US with an extensive client base.

- Conservative risk management strategy.

- Strong positions in both retail and corporate banking.

- Ability to grow even in low interest rate environments.

Buffett also highly praised the bank’s CEO, Brian Moynihan, calling him one of the best managers on Wall Street.

Despite managing billions, Buffett remains a man of simple views. In an interview, he once said: “I have five TVs at home. Why more? I watch only one anyway.”

This example isn’t about gadgets. It’s a philosophy. Buffett doesn’t chase excess. He bets on sufficiency, quality, and reason. The same applies to his portfolio: no need for 100 companies — 5–10 excellent ones are enough.

What Buffett’s “favorites” have in common

All companies Buffett invests in:

- Have a clear business model;

- Possess long-term competitive advantages;

- Generate stable cash flows;

- Have strong management he trusts;

- Sell products that consumers want again and again.

He doesn’t invest in fleeting trends. He invests in what withstands the test of time.

Warren Buffett’s portfolio is not just a list of stocks. It’s a collection of business stories he believes in. Behind each is a brand, a team, a product, and a philosophy close to Buffett himself. And if you want to learn investing — start not with numbers, but with understanding why these companies became his “favorites.”

Buffett’s Golden Rules: Principles That Have Worked for Decades

Warren Buffett didn’t just make billions — he built an ethical and logical approach to investing that has remained almost unchanged for over 60 years. While markets go crazy over news, speculation, cryptocurrencies, and hype, Buffett stays calm. Because he plays the long game. And he has a set of simple but deeply thought-out rules that help him win again and again.

Let’s break down these rules in detail — and understand why they apply not only to investing but to life in general.

- 01. Invest in businesses, not stocks

This is Buffett’s main rule — his eternal beacon. He doesn’t buy a “ticker” on the exchange. He takes a stake in a company as if he were becoming its co-owner for many years.

- He studies the business: from suppliers to customers.

- He analyzes not only the finances but also the product, management, and company philosophy.

- It’s important for him whether the company will make money regardless of market prices.

When Buffett buys a stake in Apple, Coca‑Cola, or Bank of America, he’s not guessing what will happen tomorrow. He evaluates whether the business will be useful to millions of people 10–20 years from now.

- 02. Think decades ahead

In a world where most investors operate on a “buy and dump” mode, Buffett chooses the path of a long-term holder. He’s not afraid of volatility. He knows true value reveals itself over the years. Examples from his life:

- He has held Coca‑Cola shares since 1988. Over 35 years — and doesn’t plan to sell.

- His investment in American Express has been ongoing since the 1960s.

- He entered Apple in 2016 — and only increased his stake despite the drops.

This approach brings not only profit but also peace of mind: no constant fear or jitters from the news. Buffett plays the game with a time advantage.

- 03. Avoid debt — especially in crises

Buffett has never been a fan of leverage. Even if it speeds up profits, it increases the risk of wiping out. He often says: “You only find out who’s been swimming naked when the tide goes out.” Meaning: when everything is going well, borrowed money seems like a “convenient cushion.” But once the market falls — you’re left defenseless. Buffett maintains debt prudence even in managing Berkshire Hathaway:

- The company always holds multibillion cash reserves.

- During crises, Buffett doesn’t seek help — he becomes a “rescuer” for others (as in 2008 and during the pandemic).

- 04. Stick to principles — don’t follow the crowd

Since youth, Buffett learned: emotions are the investor’s biggest enemy. The market is often irrational. People buy on rumors, sell on fear, react to headlines rather than facts. Buffett has always adhered to 3 internal rules:

- Invest only in what you understand

If it takes you ten minutes to explain the business — don’t buy it. He avoided tech startups, cryptocurrencies, and hype IPOs — because he didn’t see a stable model there. - Don’t give in to panic and rumors

When the market falls, Buffett doesn’t sell. He buys. He called crises “Wall Street sales” — and used them as chances to buy great businesses at a discount. - Trust reason, not emotions

He never falls prey to greed. He can refuse a deal if he sees his internal guidelines violated. Including moral ones.

- 05. Honesty in business is worth more than money

Warren Buffett is known for his strict ethical code. He does not work with companies and people who don’t earn his trust. His famous quote: “Look for three things in partners: integrity, intelligence, and energy. If you don’t have the first, the other two will kill you.”

He applies this rule both to investments and his team. He gives managers freedom but demands high standards of conduct. Because reputation, according to Buffett, is built over decades — and can collapse in 5 minutes. Berkshire Hathaway is one of the most respected companies not only for its money but also for the values it carries. This is the result of ethics, not just calculation.

Buffett’s rules are not “magic formulas,” but common sense brought to a system. And they work not only for billion-dollar portfolios but also for personal finances, careers, and decision-making:

- Understand what you are doing;

- Play the long game;

- Avoid unnecessary risks;

- Be honest with yourself and others.

This is his main lesson: success is not about guesses, but discipline and character. And Buffett has proven it with his entire life.

“Giving Wealth to the Living”: How Buffett Is Changing the World Without Waiting for Monuments

Warren Buffett is one of the richest people on the planet. But his true greatness is not in the ten-digit figures in his bank accounts. Buffett’s real power lies in his decision to give away nearly his entire fortune for the benefit of others. Not after death. But during his lifetime. Consciously. Honestly. Quietly and consistently.

This is not PR. It’s his conviction. He truly believes that money only makes sense when it works to improve someone’s life. And he fulfills this mission not alone, but together with people he trusts just as much as he once trusted Coca-Cola or Apple.

- 01. The promise that shook the world

In 2006, Buffett publicly announced that he would donate 99% of his wealth to charity. At that time, it was tens of billions of dollars. Since then, he annually transfers Berkshire Hathaway shares to various foundations. The main beneficiary is the Bill & Melinda Gates Foundation, the world’s largest private charitable organization focused on:

- Fighting global diseases (malaria, tuberculosis, polio);

- Developing education in developing countries;

- Improving access to clean water, sanitation, and healthcare;

- Creating sustainable agricultural systems;

- Supporting scientific research in healthcare.

“I have more money than I need. Bill and Melinda have more knowledge and structure to manage it. It’s the perfect partnership,” Buffett explained his choice.

- 02. A simple but powerful mechanism: stocks instead of checks

Buffett does not give money directly. Instead, he donates Berkshire Hathaway shares annually. This allows the foundations to:

- Manage assets independently as needed;

- Avoid taxes and transaction losses;

- Preserve the long-term value of donations.

Each donated share is not just a number. It’s a real business: from GEICO insurance to BNSF Railway logistics, from See’s candies to Duracell batteries. Tens of thousands of employees working to make the world better — through production, sustainability, and economy.

- 03. How much has he given away?

As of 2025, Warren Buffett has donated over 50 billion dollars. This is:

- The largest charitable contribution in human history.

- More than 50% of all Class B Berkshire Hathaway shares that were at his disposal.

- Millions of lives saved or changed thanks to these funds.

Besides the Gates Foundation, Buffett annually donates to four family foundations managed by his children and grandchildren: Susan Thompson Buffett Foundation (in honor of his late wife), Sherwood Foundation, Howard G. Buffett Foundation, NoVo Foundation (foundations of his daughter and daughter-in-law). In this way, he delegates responsibility for improving the world not only to external organizations but also to his family, creating a legacy of values.

- 04. Why he doesn’t want to leave a fortune to his children

Buffett has always been frank: his children will not receive the entire fortune. In his words: “Leaving children too much is like giving them iron boots instead of wings.” He believes that excessive inheritance destroys motivation, and it’s better to give children education and support rather than “a check for eternal vacation.” He wants them to create, not live in the shadow of his achievements. At the same time, Buffett supports their charitable initiatives and is proud that his children are not “golden youth” but active participants in social projects. - 05. The Giving Pledge: an initiative for billionaires

In 2010, Buffett together with Bill and Melinda Gates launched The Giving Pledge — a global campaign that encourages the wealthiest people on the planet to promise to donate at least 50% of their fortune to charity. Since then, people like Elon Musk, Mark Zuckerberg, Michael Bloomberg, George Lucas, Richard Branson, and hundreds of other billionaires worldwide have joined the movement. Buffett says this is not so much about money as about a mindset shift: wealth should serve the world, not just the owner. - 06. What he considers true investment returns

Buffett is convinced that the best investments are investments in people. They don’t always pay back in profits, but they pay back in meaning. “If you find yourself with more than you need — help those who have less than enough.”

For him, charity is not a way to “redeem capitalism” but a continuation of his investment logic: invest in the future, in development, in health, in education — and you’ll get a society where people want to live.

Buffett could have bought ten yachts, private islands, palaces, and football clubs. But instead, he invests his fortune in what makes the world healthier, more educated, and safer. His actions are a challenge to the era of overconsumption.

He has shown that truly great investors don’t accumulate — they give back. And this is perhaps the most valuable lesson to learn from him.

Myths and Reality about Warren Buffett: Investment Guru or Just Common Sense?

The name Warren Buffett is surrounded by many legends, rumors, and vivid images. To some, he is a mysterious financial genius; to others, the embodiment of the American dream; and to others still, simply the “Wall Street wizard.” But what really lies behind this image? Let’s debunk the most common myths and look at the reality of this great investor.

- Myth #1: Buffett is just a skilled financier

This stereotype is often heard from those who don’t dig deeper. Many believe that Buffett’s success is the result of “playing the stock market,” knowing the tricks of speculation, and reading complex charts.

Reality: Buffett is, above all, a guru of common sense. His approach is much simpler than it appears at first glance. “I just try not to do stupid things and think like a business owner, not a trader,” he has said more than once. He doesn’t chase trendy fads, doesn’t panic, and doesn’t aim to “beat the market” in the short term.

Buffett has never used complicated financial models based on probabilities and mathematics. His “secret” is intuition backed by an understanding of business fundamentals and strict discipline. - Myth #2: The more you own, the better

In the investing world, there is a belief that diversification is the key to safety, and the more companies you have in your portfolio, the better. Many investors literally try to “buy the entire market,” hoping this will protect their investments from failure.

Reality: Buffett believes in sensible diversification, not uncontrolled spreading of capital.

He calls diversification “protection for those who don’t understand what they’re doing.” His own portfolio is focused and concentrated on 5–10 key companies he deeply believes in. At the same time, Buffett always keeps part of his capital in cash — to have the freedom and the ability to seize profitable opportunities at any moment. - Myth #3: Buffett is an “eternal investor” who never makes mistakes

Sometimes an image is created of a person who always knows everything and never errs.

Reality: Buffett is a person who learns from mistakes and is not afraid to admit them. He publicly acknowledges failures and openly discusses his errors — for example, investments in IBM or Tesco that did not meet expectations. “The main thing is not to make the same mistakes twice.” This honesty and openness is one of the reasons for his authority. He is not afraid to admit that even the best investors can be wrong. - Myth #4: Buffett’s success is a matter of luck

Some think Buffett just got lucky — born at the right time, in the right place, and everything fell into place by itself.

Reality: Buffett built his success through system, discipline, and continuous development. He reads up to 500 pages a day, which allows him to quickly analyze information and make well-founded decisions. His patience and ability to wait are not luck, but skills.

Most myths about Warren Buffett arise from attempts to explain a phenomenon that seems supernatural. But in reality, he is a person who:

- Thought strategically, not emotionally;

- Understood business, not just played with stocks;

- Maintained discipline and did not follow trends;

- Learned from mistakes and was not afraid to admit them.

Buffett is an example of how common sense, resilience, and honesty can create legends. And if you want to follow in his footsteps, start with something simple: think like an owner, not a speculator.

15 Amazing Facts About Buffett You Didn’t Know

Warren Buffett is not just one of the richest people in the world, but a true legend of investing. Behind his billions hides not only financial genius but also unusual habits, paradoxical decisions, and even a sense of humor. Did you know he still lives in a house he bought for $31,500? Or that he loves Coca-Cola but doesn’t trust tech startups? In this section — the most interesting and unexpected facts about the “Oracle of Omaha.”

- 01. Doesn’t use expensive gadgets

He doesn’t have an iPhone — Buffett still uses a basic cell phone. Also, he never checks stock quotes in real time. - 02. Pays less taxes than his secretary

Due to peculiarities of the US tax system, Buffett long paid a lower tax rate than his employees. This became the reason for his famous speech about the unfairness of the system. - 03. Plays the ukulele and sings in music videos

In 2017, he appeared in a Coldplay music video and occasionally performs concerts playing the ukulele. - 04. His annual letters to shareholders are bestsellers

Buffett’s letters to Berkshire Hathaway shareholders are studied like investment textbooks. Some investors pay thousands of dollars to attend his annual meetings. - 05. Was afraid of public speaking in his youth

To overcome his fear, he enrolled in Dale Carnegie courses. Now his annual talks in Omaha attract tens of thousands of people. - 06. Pays himself $100,000 a year

This has been his official salary since the 1960s. For comparison, the CEO of Disney earns 300 times more. - 07. His wife made him start wearing suits

Until age 30, Buffett wore worn-out shirts. His wife Susie literally forced him to buy a business wardrobe. - 08. Keeps cash in a safe, not in a bank

He doesn’t trust credit cards and always carries a few hundred dollars in cash. - 09. Ran away from home at 12

After his parents’ divorce, young Buffett tried to go to his father in Washington, hiding on a train. Police returned him home. - 10. Forbade his children to call him “Dad”

In the Buffett family, there was a rule: children had to call him “Warren.” He believed familiarity was harmful for upbringing. - 11. Secret Coca-Cola room

His office has a special fridge always stocked with his favorite Cherry Coke. Only Buffett has the key. - 12. Gave stocks as wedding gifts

Instead of money, he gives newlyweds Berkshire Hathaway shares with the condition not to sell them for 10 years. Many became millionaires. - 13. “Cursed” $500 sofa

Since the 1960s, a worn-out sofa has stood in his office. He refuses to buy a new one, calling it an “unnecessary luxury.” - 14. Mysterious “Room 222”

At Berkshire’s headquarters, there is a room where even top managers are forbidden entry. Only Buffett knows what’s inside. - 15. Last check for $…

He has a symbolic check that he plans to write on the last day of his life. The amount and recipient are unknown.

Buffett has proven that success is not just about money but also about discipline, simplicity, and a sense of humor. He doesn’t chase luxury, doesn’t follow trends, and stays true to his principles. Perhaps that is the secret of his phenomenal success.

Buffett is a walking paradox: he bets on conservative assets but outperforms everyone; hates technology but profits from it; could buy an island but lives like a math teacher. His life proves that true success is not about money but about the freedom to be yourself.

Feel the spirit of business and get closer to Buffett’s philosophy with American Butler

Warren Buffett teaches us not only how to become wealthier but, above all, how to think. His approach is a strategy that easily applies to personal finances. Don’t blindly trust numbers or market downturns: seek meaning, understand the business, and build your path step by step.

Let American Butler show you the way to new knowledge and discoveries. We organize:

- VIP tours to key business landmarks in the USA: Wall Street, Apple campus, Berkshire Hathaway headquarters in Omaha;

- Intellectual seminars analyzing investment philosophy.

Rethink finance through Buffett’s eyes — with comfort and tours to suit every taste.