The Great Depression was one of the most severe economic crises in the history of the United States and the world. Beginning in 1929 with the stock market crash, it spread across the entire U.S. economy, triggering mass unemployment, bank failures, and plunging millions into poverty. The crisis lasted for over a decade and led to fundamental changes in U.S. politics, economics, and social policy.

This period provided crucial lessons that influenced the development of the financial system, government regulation, and social welfare policies. How did the U.S. overcome the crisis? What reforms helped rebuild the economy? And how did the Great Depression shape the future of the country? In this article, we will explore the causes, consequences, and long-term changes brought about by this historic event.

The Roots of the Great Depression in the U.S.

The Great Depression of 1929–1939 was one of the most devastating economic crises in U.S. history. However, its origins can be traced back to the early 20th century.

- 01. World War I

The U.S. became the primary creditor for warring nations, leading to an economic boom but also creating financial risks. After the war, demand for American goods plummeted, hitting both industry and agriculture hard. Additionally, European countries, struggling with economic difficulties, were unable to repay their massive debts to the U.S., weakening the American economy. - 02. Mass Immigration

A surge of workers from Europe led to demographic shifts and social tensions. Many immigrants worked low-wage jobs and were often the first to suffer during economic downturns. Competition for jobs increased, driving down wages and raising unemployment among American workers. - 03. Racial Unrest

Growing racial conflicts in urban areas worsened social and economic conditions. African Americans faced severe discrimination and were often the first to lose their jobs during the crisis. The Ku Klux Klan also became more active during this period, leading to a rise in violence and deepening social divisions. - 04. Rapid Urbanization

The rapid growth of cities overwhelmed infrastructure and increased unemployment among farmers who moved in search of work. Overcrowded urban areas with poor living conditions contributed to social instability. - 05. Rise of Industrial Conglomerates

The concentration of wealth in large corporations led to monopolization and economic inequality, overheating the market. Small and mid-sized businesses struggled to compete, often failing in the process. - 06. Technological Advancements

The rise of automobiles, radio, and electricity transformed labor markets and consumer behavior. Assembly line production increased output but also eliminated many jobs by replacing workers with machines. - 07. Prohibition (1920–1933)

Restrictions on the alcohol industry led to the rise of a black market and organized crime, while also reducing tax revenues. The closure of breweries, distilleries, and bars resulted in job losses for thousands. - 08. Birth Control, the Sexual Revolution, and Women’s Emancipation

Social changes influenced labor markets and family economic models, reshaping traditional societal norms. Women became more involved in economic life, leading to shifts in employment and demographics. - 09. Growth of the Advertising Industry

Aggressive marketing campaigns encouraged consumer culture, prompting people to spend more and take on increasing amounts of debt. - 10. Expansion of Consumer Credit

Banks issued loans for cars, homes, and household appliances, but many borrowers were unable to repay them, worsening the financial crisis. People became accustomed to living on credit, unaware of the looming catastrophe.

The Stock Market Crash: A Chronicle of Economic Catastrophe

The stock market crash of 1929 was triggered by a combination of factors:

- Speculation and a Market Bubble

In the 1920s, the U.S. stock market soared, and many investors, including ordinary citizens, poured money into stocks, expecting constant growth. Buying stocks on margin (using borrowed money) fueled demand, artificially inflating prices. - Easy Money Policy

The Federal Reserve lowered interest rates, making credit more accessible. Many companies and individuals took out loans to invest in the stock market. - Economic Overheating

Industries were producing more goods than the market could absorb. However, wage growth did not keep pace, creating a supply-demand imbalance. - The Crash of October 24, 1929 (“Black Thursday”)

Investors began selling off stocks in panic, triggering a chain reaction of price declines. By October 29 (“Black Tuesday”), the market had completely collapsed. - The Domino Effect

Banks that had invested heavily in stocks went bankrupt. Companies laid off workers, unemployment soared, and the economy spiraled into a decade-long depression.

This crash marked the beginning of the Great Depression, exacerbating financial and social issues in the U.S.:

- The stock market overheated, with investors pouring money into overvalued stocks.

- Panic-driven stock sell-offs led to Wall Street’s collapse.

- Millions lost their savings, triggering a wave of bankruptcies and unemployment.

- The national debt increased, while household incomes plummeted.

To compensate for budget deficits, the government raised taxes, but this only reduced consumer spending and worsened the crisis.

- Tax Increases

Between 1932 and 1936, tax rates on incomes over $1 million rose from 25% to 79%. - New Levies

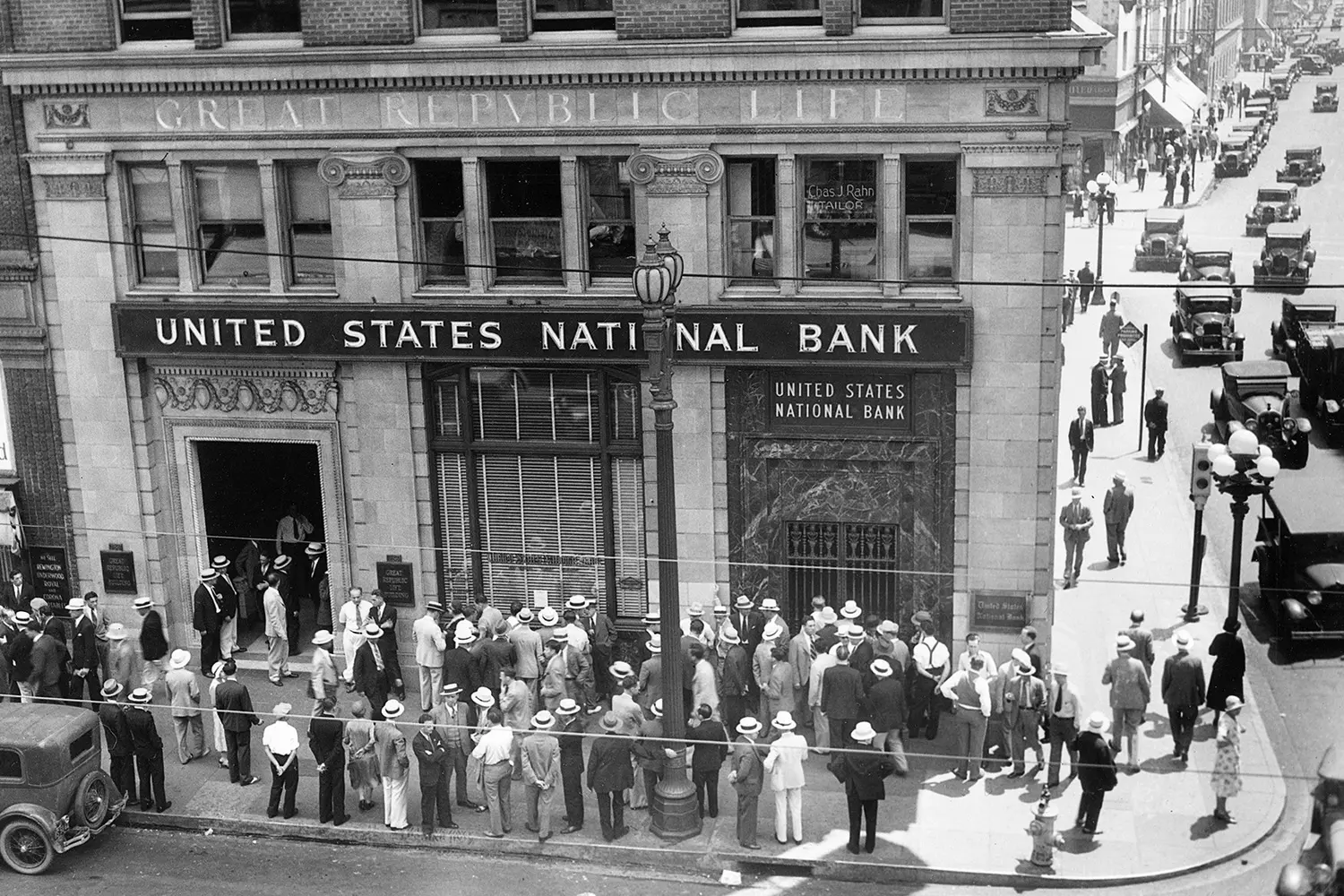

Taxes on corporate profits, inheritances, and dividends were introduced. - Banking System Collapse

The government was forced to intervene and reform the financial sector.

How the Great Depression Transformed America

The Great Depression was a period of radical transformation across all aspects of American life, including business. The crisis didn’t just bankrupt thousands of companies — it reshaped the very philosophy of entrepreneurship, forcing businesses to rethink their strategies and adapt to new economic realities.

Mass Bankruptcies and Market “Cleansing”

- Financial Collapse

By 1933, 40% of U.S. banks (over 9,000) had failed, cutting off businesses from credit. - Wave of Business Closures

Up to 50,000 businesses disappeared annually, including major institutions like the Bank of the United States (which collapsed in 1931, affecting 400,000 depositors). Hard-Hit Industries

Construction (an 80% decline), auto manufacturing (Ford’s annual sales dropped from 1.5 million to 500,000 vehicles), retail (chains like Woolworth’s shut down 20% of their stores), General Motors survived only by cutting its workforce by 50% and shifting to lower-cost models.

Innovation as a Survival Strategy

Businesses that endured the crisis adopted creative strategies:

- Coca-Cola

Introduced 6-ounce bottles for 5 cents instead of larger formats. - Procter & Gamble

Focused on affordable, disposable goods (e.g., Camay soap). - Supermarkets

Emerged (King Kullen opened the first self-service store in 1930). - Rental businesses

For clothing and tools flourished as people sought ways to save money. - Movie studios (Warner Bros., MGM)

Increased low-cost film production — 85 million Americans attended theaters weekly as a form of escapism.

Government vs. Business: Forced Evolution

President Franklin D. Roosevelt’s policies dramatically reshaped the economic landscape:

- Antitrust Measures

Morgan Bank and Standard Oil were broken into smaller companies. - Increased Corporate Taxes

Corporate tax rates jumped from 12% to 24%, and dividends were taxed at the source. - Stronger Labor Unions

The Wagner Act (1935) legalized unions, forcing businesses to raise wages (steel industry wages rose by 40% by 1937). - Small Business Decline

The share of businesses earning under $50,000 annually dropped from 75% to 60%, while large corporations (IBM, DuPont) solidified their dominance.

Collapse and Restructuring of Industry

The Great Depression was a disaster for American industry, but at the same time, it became a period of profound transformation. The crisis didn’t just shrink production — it reshaped the structure of industry itself, labor relations, and the role of the government in the economy.

Key Indicators of the Decline (1929–1933)

- Total industrial output dropped by 46%, falling to 1905 levels.

- Steel production plunged by 76% — blast furnaces across the "Rust Belt" stood idle.

- The automobile industry, the symbol of the 1920s, slashed production from 5.3 million to 1.4 million cars per year.

- Shipbuilding nearly collapsed — new orders plummeted by 90%.

- U.S. Steel, the largest steel producer, was operating at just 10% capacity in 1932, and its stock became virtually worthless.

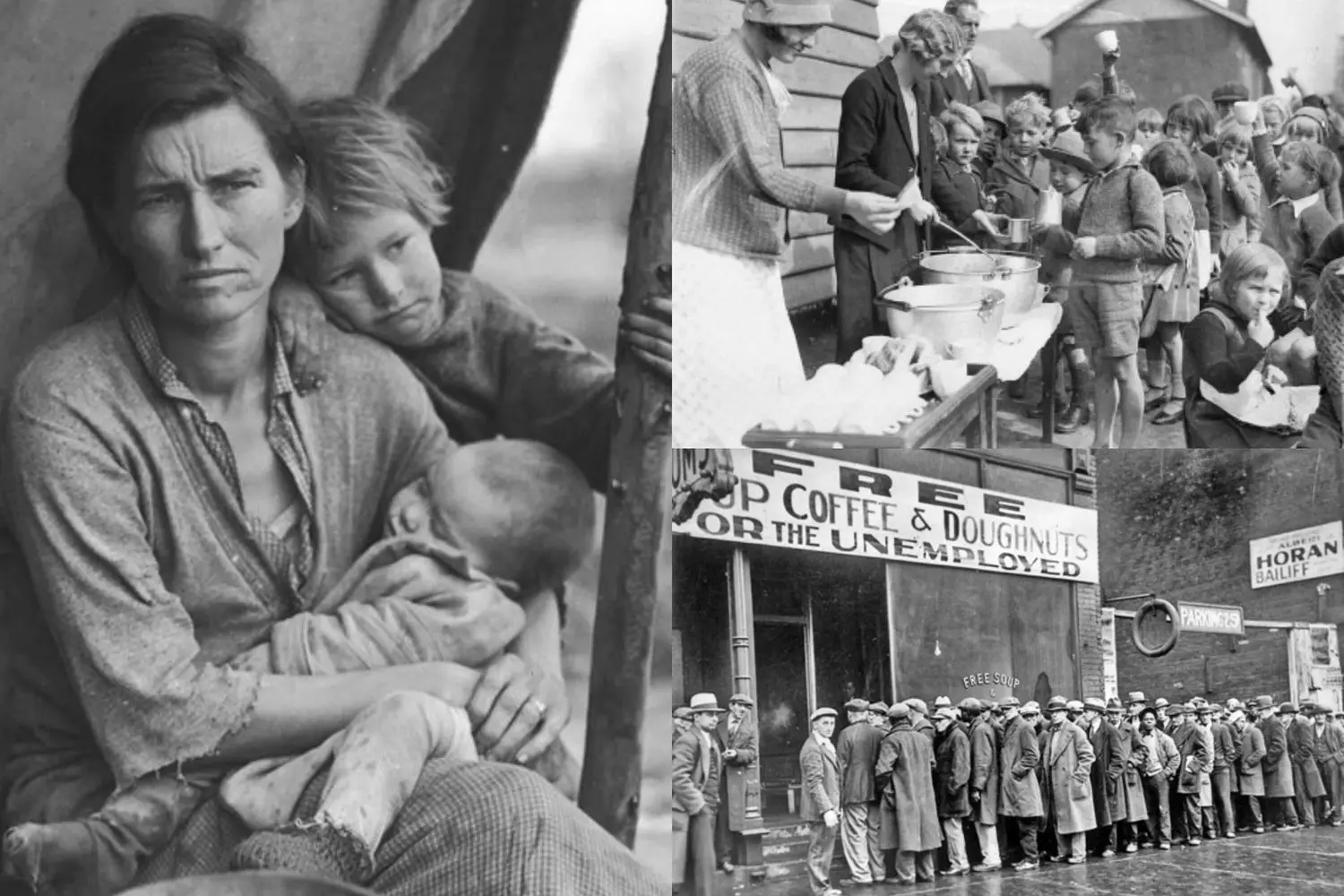

Social Consequences

- Unemployment

In industry, unemployment reached 37%, and in cities like Detroit or Pittsburgh, it soared to 80%. - Wages

Salaries fell by an average of 60%, while working hours increased to 10–12 hours a day, often with lower pay. - Hunger marches

Example: Detroit, 1932. - Factory occupations

Flint Sit-Down Strike (1936–1937).

Corporate Response

- Drastic cost-cutting

General Motors laid off 100,000 workers, while Ford cut 75,000 jobs. - Scientific management (Taylorism)

To further reduce costs, assembly lines became even stricter and more demanding.

Industries That Benefited from the Crisis

Paradoxically, some sectors not only survived but thrived:

- Tobacco industry

Cigarette sales rose by 30% — people sought cheap ways to cope with stress. - Pharmaceuticals

Demand for sedatives and antidepressants skyrocketed fourfold. - Low-cost goods production

Example: canned food and instant noodles. - Campbell Soup

Saw profits surge by 70% thanks to its cheap canned soups — dubbed "food for the unemployed."

The Impact of the Great Depression on U.S. Agriculture

The agricultural crisis had begun long before the Great Depression. After World War I, European countries restored their own production, sharply reducing demand for American goods. At the same time, mechanization led to overproduction, causing grain, cotton, and other crop prices to plummet.

North: Industrial Boom and Agricultural Modernization

- Industrial regions in the Northeast focused on urban development and factory expansion, driving urbanization.

- Farmers in the North gradually adopted new technologies, reducing the need for labor.

- However, mechanization led to mounting farm debt, as farmers took out loans for equipment but couldn’t repay them due to low crop prices.

- The government did not support farmers, leading to the bankruptcy of many family farms.

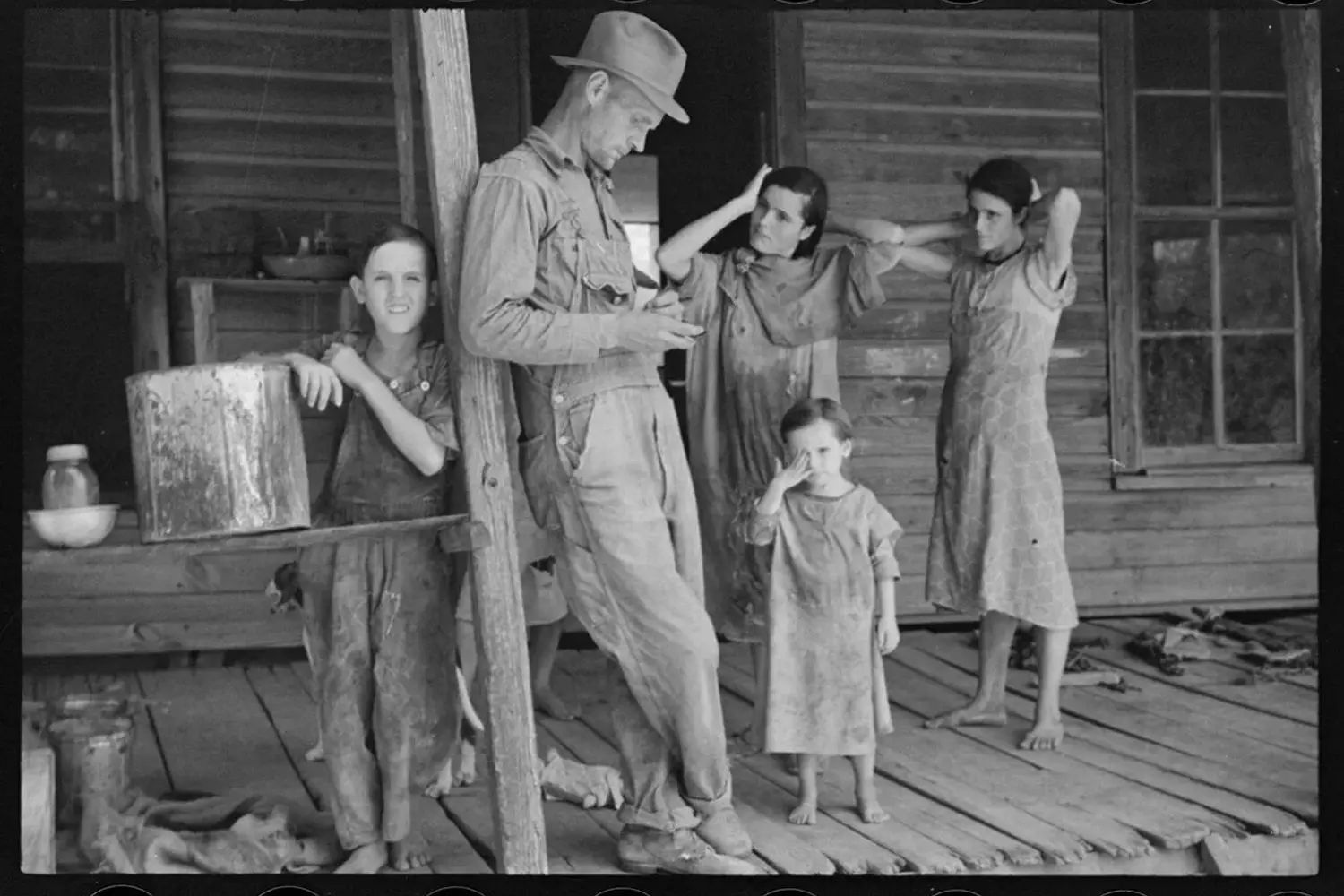

South: Dependence on Cotton and Farmer Bankruptcies

- The Southern states remained heavily agrarian, relying on plantation-style agriculture, primarily producing cotton and tobacco.

- Cotton prices collapsed, bankrupting thousands of farmers and leaving them without a livelihood.

- African American sharecroppers and tenant farmers were hit hardest, as they were completely dependent on plantation owners.

- Due to the lack of agricultural diversification, the South suffered far worse than the North during the crisis.

Life in Cities vs. Rural Areas: A Contrast of Poverty and Progress

- In cities, new technologies created jobs, but when the crisis hit, unemployment skyrocketed.

- In rural areas, mass bankruptcies forced large-scale migration in search of work.

- As a result, thousands of people left their homes and moved across the country looking for better opportunities.

- Many farmers lost their land due to debt, contributing to the formation of the Dust Bowl — an ecological catastrophe caused by soil depletion and droughts.

- 01. The Dust Bowl: Causes and Scale of the Disaster

- Droughts (1931–1939) and poor farming practices (deep plowing of prairies) turned 10 states (Oklahoma, Texas, Kansas, etc.) into a "dust desert."

- 500 million tons of topsoil were blown away — black dust storms reached New York and Washington, D.C.

- 2.5 million farmers lost their land, and 60% of livestock died from starvation and thirst.

- In 1935, one of the worst "Black Blizzards" (Black Sunday) buried homes in dust up to the ceiling, forcing families to flee.

- 02. Economic Collapse for Farmers

- Wheat prices fell threefold.

- Mortgage crisis: By 1933, 45% of farms were foreclosed — 200,000 families were evicted each week.

- Rural hunger: In Arkansas and Iowa, 40% of children were malnourished, even as the U.S. continued to export grain.

- Farmers destroyed crops (dumping milk, burying potatoes) to drive prices up, but this only deepened the crisis.

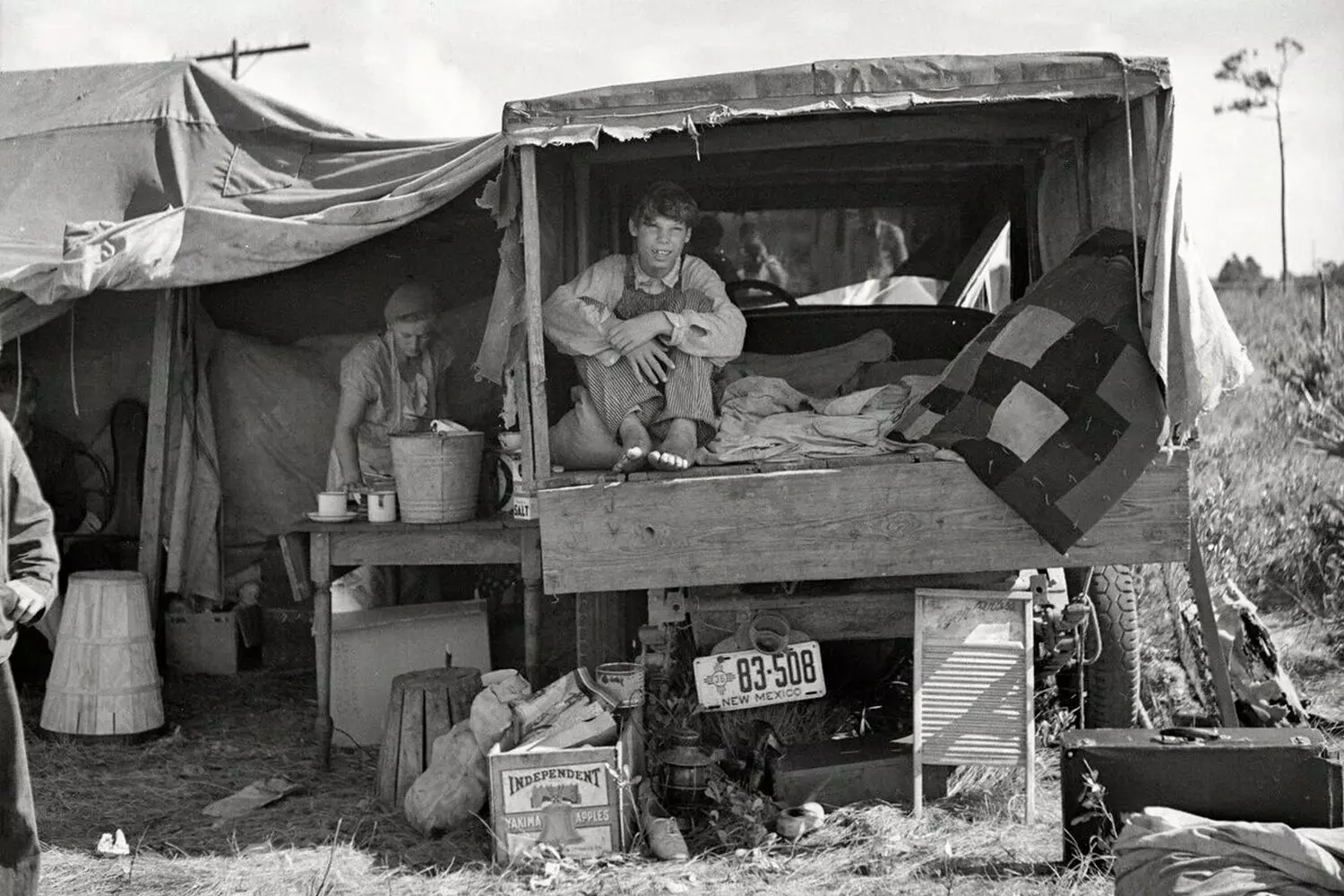

- 03. The Great Migration

- 3.5 million people (mainly from Oklahoma and Arkansas) moved westward in search of work.

- "Hoovervilles" (makeshift refugee camps) sprang up along highways — people lived in burlap tents.

- Racism: Migrants ("Okies") were treated as second-class citizens, working 12-hour shifts for just $1.

- John Steinbeck's The Grapes of Wrath captured this struggle, becoming a defining novel of the era.

From Alaska to Florida: Exploring the Multifaceted America

How the Crisis Divided America into Rich and Poor

The Great Depression wasn’t just an economic collapse — it redrew the social map of the U.S., affecting each class differently. While the rich lost fortunes but remained secure, the poor fought for survival.

The Wealthy: A Fall from Grace, but a Soft Landing

- Stock market losses

Blue-chip stocks (General Motors, U.S. Steel) fell by 80–90%. - Bankrupt tycoons

11 out of 25 of the wealthiest people in 1929 (including GM founder William Durant) went broke. - Tax hikes

The top tax rate rose from 25% to 79% (Revenue Act of 1936).

How They Survived

- Preserving assets

Real estate, gold, offshore accounts (many moved wealth to Switzerland). - "Crisis investments"

Buying up devalued assets (Rockefellers scooped up stocks at bargain prices). - Elite support networks

Exclusive clubs like Bohemian Grove provided financial and social safety nets. - Example: J.P. Morgan Jr., the famous banker, lost $60 million (around $1 billion today) but remained wealthy thanks to diversified investments.

Middle Class: The Collapse of the American Dream

- Savings wiped out: 9,000 banks shut down.

- Mortgage crisis: In 1933, one home was foreclosed every two minutes.

Social downfall: Former teachers, doctors, and engineers lined up at soup kitchens.

How They Survived

- "Living on credit"

The first credit cards (Diners Club, 1938). - Women in the workforce

Female employment rose by 25%, though wages were 30% lower than men's. - Returning to the countryside

15% of city dwellers moved in with rural relatives.

In Chicago (1932), 50% of teachers were laid off; those who remained were paid in vegetables.

The Poor: A Living Hell

- Hunger

- In New York, 20% of children were malnourished, while in the Appalachians, people resorted to eating leather shoes.

- "Hoovervilles"

Makeshift slums built from scrap materials. In St. Louis alone, 1,000 families lived in cardboard houses. - Crime

Bank robberies quadrupled, giving rise to legendary figures like Bonnie and Clyde.

Survival Strategies

- "Trains of Hope"

Desperate teenagers hopped on freight trains, traveling illegally across the country. 250,000 minors wandered in search of work and food. - Barter System

In rural areas, money became virtually nonexistent — people traded eggs for soap, firewood for medicine. - Government Aid

Through the Federal Emergency Relief Administration (FERA), people received $1.50 per week — barely enough to buy five loaves of bread. In 1933, 1,100 starving people rioted in Detroit, looting stores. Police opened fire — four people were killed.

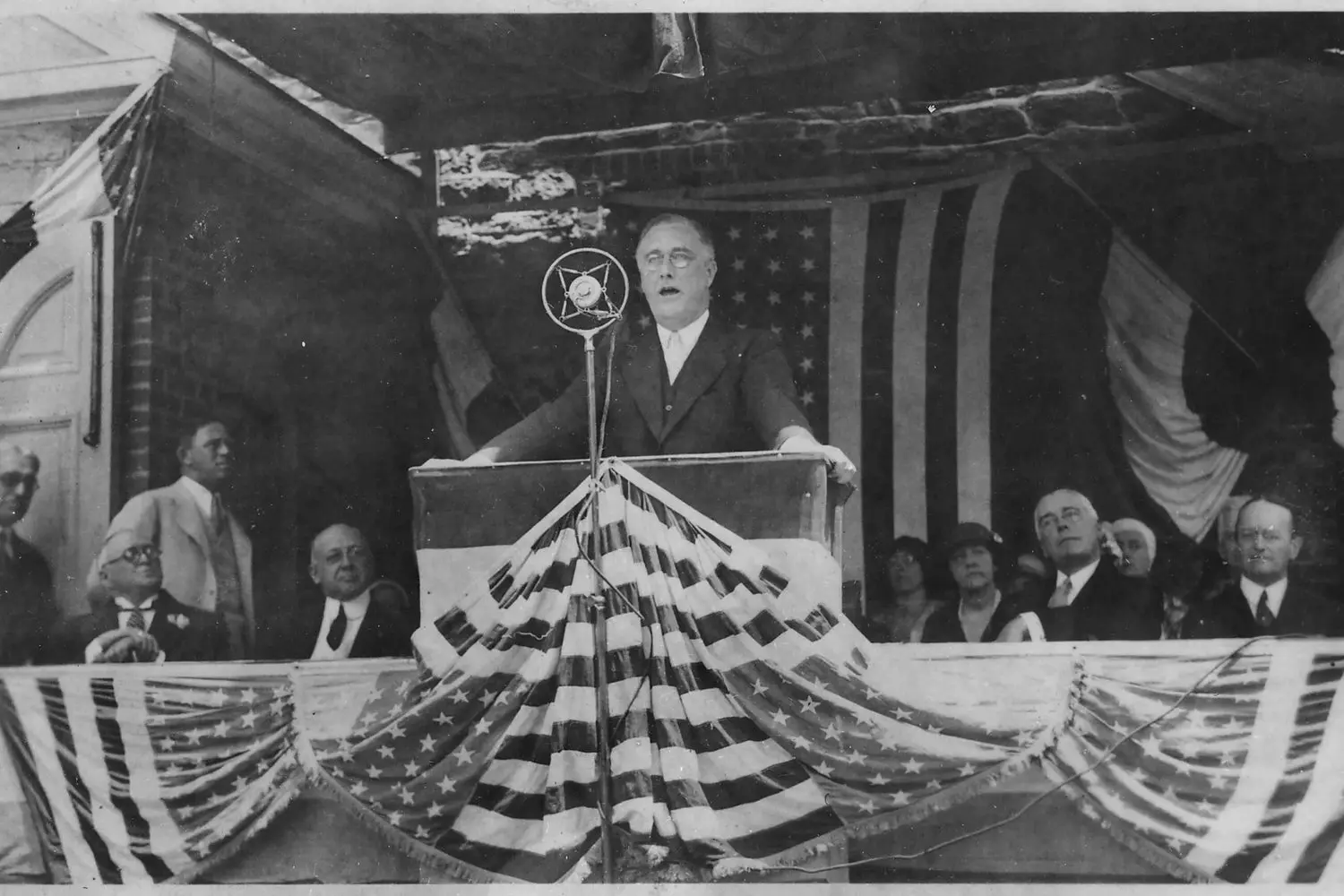

How Franklin D. Roosevelt Saved America: The New Deal & the 1932 Election

By the early 1930s, the U.S. was in its deepest economic crisis. Millions lost their jobs, unemployment surpassed 25%, thousands of banks collapsed, and farms went bankrupt. The policies of the sitting Republican president, Herbert Hoover, failed to stop the downward spiral, causing him to lose public support rapidly.

Against this backdrop, the 1932 election became a turning point for the country’s future. Americans desperately sought a leader with radical solutions to pull them out of the crisis. That leader was Franklin Delano Roosevelt, the Democratic candidate.

The Man Behind the Change: Franklin D. Roosevelt

Born in 1882 into a wealthy family, Franklin Delano Roosevelt was a distant relative of former President Theodore Roosevelt. After earning degrees from Harvard and Columbia University, he launched his political career as a New York State Senator before becoming the Governor of New York.

In 1921, Roosevelt contracted polio, leaving him partially paralyzed. However, this did not break his spirit. He remained active in politics, demonstrating unwavering resilience and determinatio — qualities that would later make him a beloved leader.

The Battle for Power: Roosevelt vs. Hoover

Roosevelt’s main opponent was President Herbert Hoover, whose laissez-faire economic policies and refusal to expand social aid had made him deeply unpopular. In contrast, Roosevelt promised bold reforms and active government intervention to rebuild the economy.

With his slogan "New Deal", Roosevelt traveled tirelessly across the country, engaging directly with the people. His charisma, optimism, and ability to inspire hope played a decisive role in the election.

On November 8, 1932, Roosevelt won a landslide victory, securing 57.4% of the vote against Hoover’s 39.7%. This marked a dramatic shift in U.S. policy.

The New Deal: Reforms That Changed America

After taking office in March 1933, Roosevelt wasted no time implementing sweeping reforms. His New Deal focused on three key areas:

- 01. Fighting Unemployment & Creating Jobs

The government launched massive infrastructure projects, building roads, bridges, dams, and power plants. Key programs included:

- Public Works Administration (PWA) — funded large-scale construction projects.

- Civilian Conservation Corps (CCC) — employed young men in environmental conservation and public works.

- 02. Banking System Reform

In March 1933, Roosevelt declared a "bank holiday", temporarily closing all banks for inspections. This led to: the shutdown of weak banks, the creation of the Federal Deposit Insurance Corporation (FDIC), protecting citizens’ savings. - 03. Social Welfare & Economic Support

- Agricultural Adjustment Act (AAA) — stabilized farm prices by subsidizing reduced production.

- Federal Emergency Relief Administration (FERA) — provided direct aid to the unemployed.

- Social Security Act (1935) — introduced pensions and unemployment insurance, a first in U.S. history.

The Impact of the New Deal

While the New Deal did not end the Great Depression overnight, it stabilized the economy, reduced unemployment, and restored trust in the financial system. Most importantly, it transformed the role of the U.S. government, making it an active player in economic and social policy.

Roosevelt remained in office until 1945, becoming the only U.S. president elected four times. His reforms laid the foundation for the modern welfare state and turned America into an economic powerhouse.

World War II & The Final End of the Great Depression

Despite Roosevelt’s efforts, the Great Depression persisted through the late 1930s. Unemployment remained high, and economic recovery was slow. The real turning point came with the outbreak of World War II in 1939.

Industrial Boom & Full Employment

When the U.S. entered the war in December 1941 after the attack on Pearl Harbor, the economy shifted to war production. This sparked an industrial surge that ultimately ended the Great Depression.

- Factories shifted to mass-producing weapons, ammunition, and military equipment.

- Millions of new jobs were created, including opportunities for women who entered the workforce in unprecedented numbers.

- U.S. GDP skyrocketed, and unemployment fell to near zero.

By the end of the war, the U.S. had emerged as the world’s leading economic and military superpower. While the New Deal helped stabilize the nation, it was World War II that truly ended the Great Depression, propelling America into a new era of dominance!

The Impact of the Great Depression on the Future of the United States

The Great Depression was one of the most significant events of the 20th century, reshaping the United States for decades to come. It exposed the fragility of the "American Dream" and not only triggered severe economic turmoil but also led to crucial social and political reforms that shaped modern American society.

Long-Term Changes and Positive Outcomes

- Expansion of Government's Role

The government took on an active role in regulating the economy and established a social safety net. - Infrastructure Development

The construction of roads, bridges, and power plants stimulated economic growth. - Changing Role of Women

Women entered the workforce in large numbers, laying the foundation for their increased participation in the economy. - Financial Reforms

New policies were introduced to protect depositors and regulate the banking system. - Rise of U.S. Global Influence

Economic stability allowed the country to emerge as a world leader.

A Lasting Legacy for Modern Business

The Depression set the stage for:

- Diversification

Companies learned not to rely on a single product. - Financial Caution

Building reserves and securing insurance became standard practice. - Corporate Social Responsibility

Employee benefit packages, including pensions and health insurance, became the norm.

How the Depression Transformed Industry Forever

The Great Depression shattered the old industrial model but built a new one — leaner, more efficient, and socially conscious. Its lessons remain relevant today, especially in times of crisis.

- Automation Boom

The crisis accelerated the replacement of human labor with machines. - Rise of Consumer Culture

A shift toward affordable mass-market products. - Globalization of Production

Companies began outsourcing labor to cut costs. - Stronger Labor Unions

Standardized work conditions, including the 8-hour workday and minimum wage regulations.

The End of the "Family Farm"

The Great Depression also wiped out traditional farming, paving the way for modern agribusiness — efficient, technology-driven, and government-supported.

- Agricultural Industrialization

Small farms went bankrupt, giving rise to large corporate-owned farms. - Mechanization

By 1940, tractors had replaced 5 million farmworkers. Government Support

Subsidies and quotas became the norm, with U.S. farm subsidies averaging $20 billion per year.

We witnessed the end of one America and the birth of another.From the diary of banker Thomas Lamont, 1933

A Turning Point in History

The Great Depression taught the U.S. and the world invaluable lessons. It underscored the need for government regulation of the economy, financial market oversight, and social protections for the population. In its aftermath, the foundations of the modern financial system were laid, infrastructure development expanded, and the government's role in economic processes was solidified.

Would you like to learn more about life in the U.S., its history, or business opportunities? American Butler is here to help you navigate American culture, economy, and laws. We offer expert consultations, guided tours, and business support services.

Contact us today and discover America!