America is a country built on freedom, entrepreneurship, and… oil. It was oil that helped transform the United States into the world’s largest economy. Oil can be compared to an engine that launched industrialization, fueled the growth of cities, transportation, the military, and financial markets. The 20th century — and America itself — are unimaginable without oil.

The US oil industry is more than just fuel. It represents thousands of jobs, innovations in extraction technologies, strategic reserves, and influential multinational corporations. It involves politics and diplomacy, sanctions and military operations that affect the fate of entire nations. It’s a topic that concerns environmentalists, economists, businesspeople, journalists, and everyday consumers at the gas pump.

The saying “follow the oil” remains relevant today for understanding global politics. Where there is oil, there are interests. Where there are interests, decisions follow. The US actively plays on this field — as a producer, consumer, technological leader, and political power.

Today, the United States not only supplies itself with oil but also exports it abroad, competing with traditional exporters. The shale revolution has upended global energy dynamics, and American oil regions like Texas and North Dakota have become economic engines.

Oil is both a source of pride and a subject of criticism. On one hand, it gave the country independence, growth, and power. On the other, it raises questions about sustainability, pollution, and the need to transition to green energy.

Let’s explore how the US oil market is structured, who controls production, where the major fields are located, why America became an oil exporter, and how oil affects each of us. This material will help you understand why just a few drops of black gold can shake the entire global economy.

The Strategic Petroleum Reserve is stored in underground salt caverns in Texas and Louisiana. In 2022, the Biden administration began a large-scale sale of reserves — up to 1 million barrels per day — reducing the stockpile to its lowest level since 1983.

The First Drop: How Oil Changed the United States Forever

The history of oil in the USA didn’t begin in the deserts of the Middle East or on offshore platforms. It began in the green hills of Pennsylvania, where in 1859 engineer Edwin Drake drilled the world’s first commercial oil well. The small town of Titusville became the epicenter of a major revolution.

Before that, oil was collected from natural seepages — Native Americans and settlers gathered it by hand, using it for lighting and healing. But drilling marked a turning point. The "oil rush" began — a direct analogy to the gold rush, only instead of nuggets, they were searching for liquid gold.

- 01. The birth of oil empires

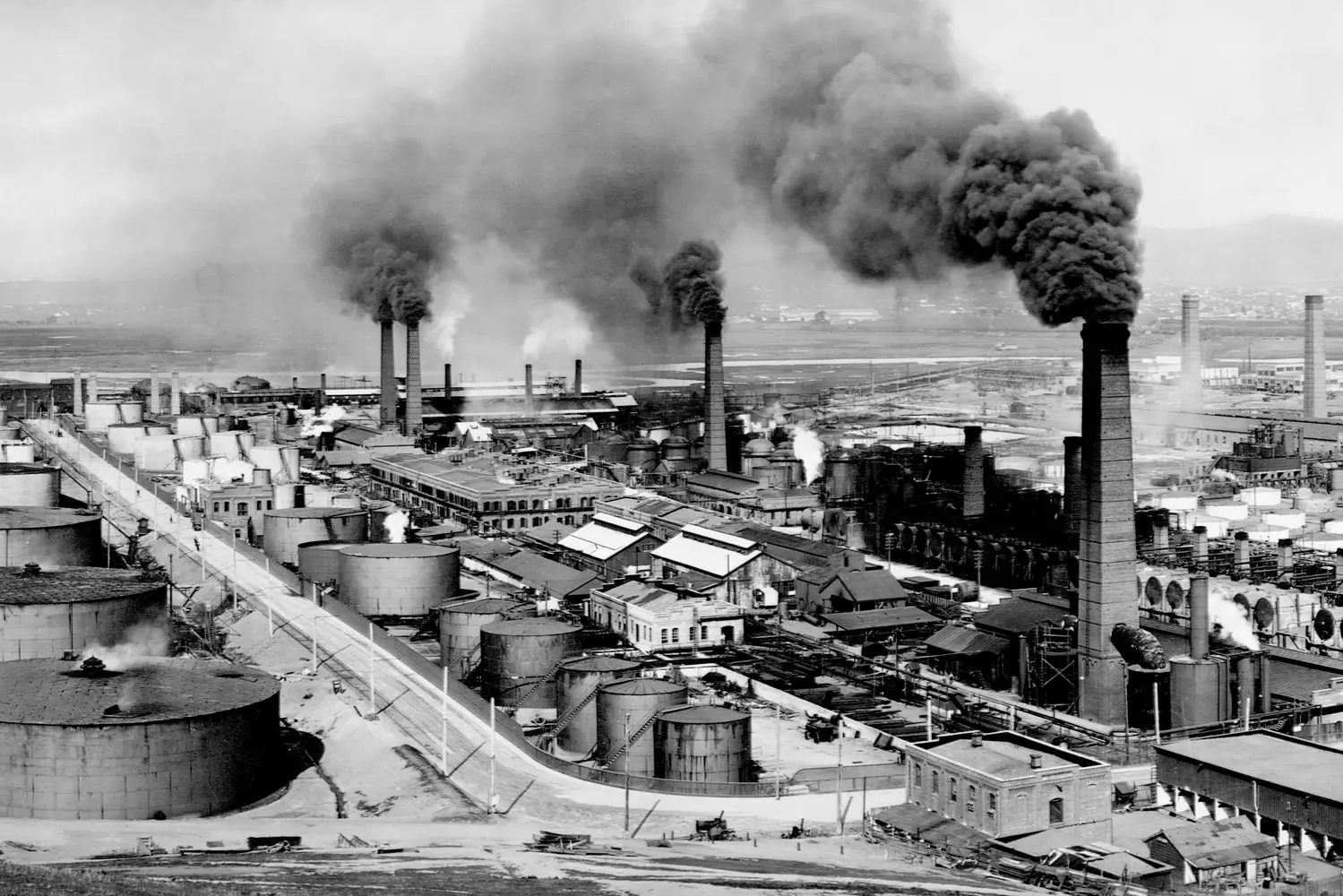

The advent of oil dramatically transformed the US economy. At the turn of the 19th and 20th centuries, America became the world’s leading oil producer, supplying up to 60% of global demand. This era saw the rise of the first oil magnates, the most famous being John D. Rockefeller. His company Standard Oil not only controlled production and refining but also dictated world prices.

The development of railroads, the automobile industry, and shipping all relied on stable oil supplies. The US entered the 20th century as an energy superpower, firmly holding the valve to the oil flow. - 02. Changing geography: Texas, Oklahoma, Alaska

With growing fuel demand and advancing technologies, oil exploration expanded to other regions. Texas was a true discovery. In 1901, the Spindletop well unleashed a massive oil gusher — 100,000 barrels a day. This event opened a new chapter: the South of the US became the oil capital.

In the 1920s and 1930s, Oklahoma and California also actively joined production. By the mid-20th century, oil fields in Alaska, especially the rich Prudhoe Bay, began development, becoming one of the largest in the country.

Each discovery was followed by an infrastructure boom: pipelines, refineries, ports, and cities were built. America grew alongside its oil. - 03. The energy crisis and challenge of the 1970s

However, the rapid growth could not last forever. By the 1970s, the American oil industry faced challenges: old fields were depleting, production was declining, while consumption continued to rise. Increasing amounts of oil had to be imported.

The critical moment came in 1973. OPEC countries imposed an oil embargo on the US in response to its support for Israel. Oil prices quadrupled. Gas stations saw long queues, inflation surged, and the economy wobbled. Energy dependence became a matter of national security.

This crisis was a lesson. The US began seeking new energy sources, investing in alternatives, and strengthening control over strategic reserves. From this period onward, oil definitively transitioned from a mere resource to a strategic weapon.

Shale Revolution: How the USA Reclaimed Its Oil Empire

In the early 2000s, it seemed that the golden age of American oil was a thing of the past. Oil fields were depleting, dependence on imports was growing, and debates about alternative energy were gaining momentum. But no one expected that a new revolution was brewing deep within the seemingly unpromising layers of the earth.

Shale oil is oil trapped in dense, layered rocks from which it was impossible to extract using traditional methods. But in the 2000s, everything changed thanks to the development of two technologies:

- Horizontal drilling

This method allows extraction parallel to the rock layer, significantly increasing recovery volumes. - Hydraulic fracturing (fracking)

A process in which water mixed with chemicals and sand is injected into wells at high pressure, cracking the rock and releasing oil and gas.

These methods were known before, but only the combination of new materials, digital control, and cheap credit made them widespread and economically viable.

The results exceeded all expectations. In just a few years, the USA:

- Became the world’s largest oil producer, surpassing Saudi Arabia and Russia;

- Achieved energy independence, completely eliminating imports of certain types of oil;

- Started exporting oil, something that seemed impossible just 15 years ago;

- Triggered an economic boom in Texas, North Dakota, New Mexico, and other regions;

- Lowered domestic fuel prices, benefiting both industry and consumers.

Interesting fact: in 2023, the USA produced more than 13 million barrels of oil per day for the first time in 70 years — more than ever before in the country's history.

The success of the shale revolution came with challenges:

- Environmentalists raised alarms over groundwater contamination and potential earthquakes;

- Many companies faced debt problems, especially after the 2014 oil price crash;

- Fracking technologies still require significant amounts of water and chemicals.

Nevertheless, the USA proved that with willpower, capital, and innovation, even the impossible can become reality.

The shale revolution was not just a technological breakthrough — it changed the balance of power on the global stage. America once again sets the rules of the game, relying not only on weapons and diplomacy but also on the oil needle it has learned to control itself.

Numbers That Move the World: Oil Statistics in the USA

The oil industry in the USA is not just about history and technology. It also involves a colossal amount of data that allows us to assess the true scale of oil’s impact on the economy and society. Let’s break down the key indicators that define the USA’s position on the global oil map.

- 01. Production Volumes

- In 2023, the USA produced an average of 13.1 million barrels of oil per day — an all-time record for the country.

- Over the year, this amounts to more than 4.8 billion barrels — approximately 15% of global production.

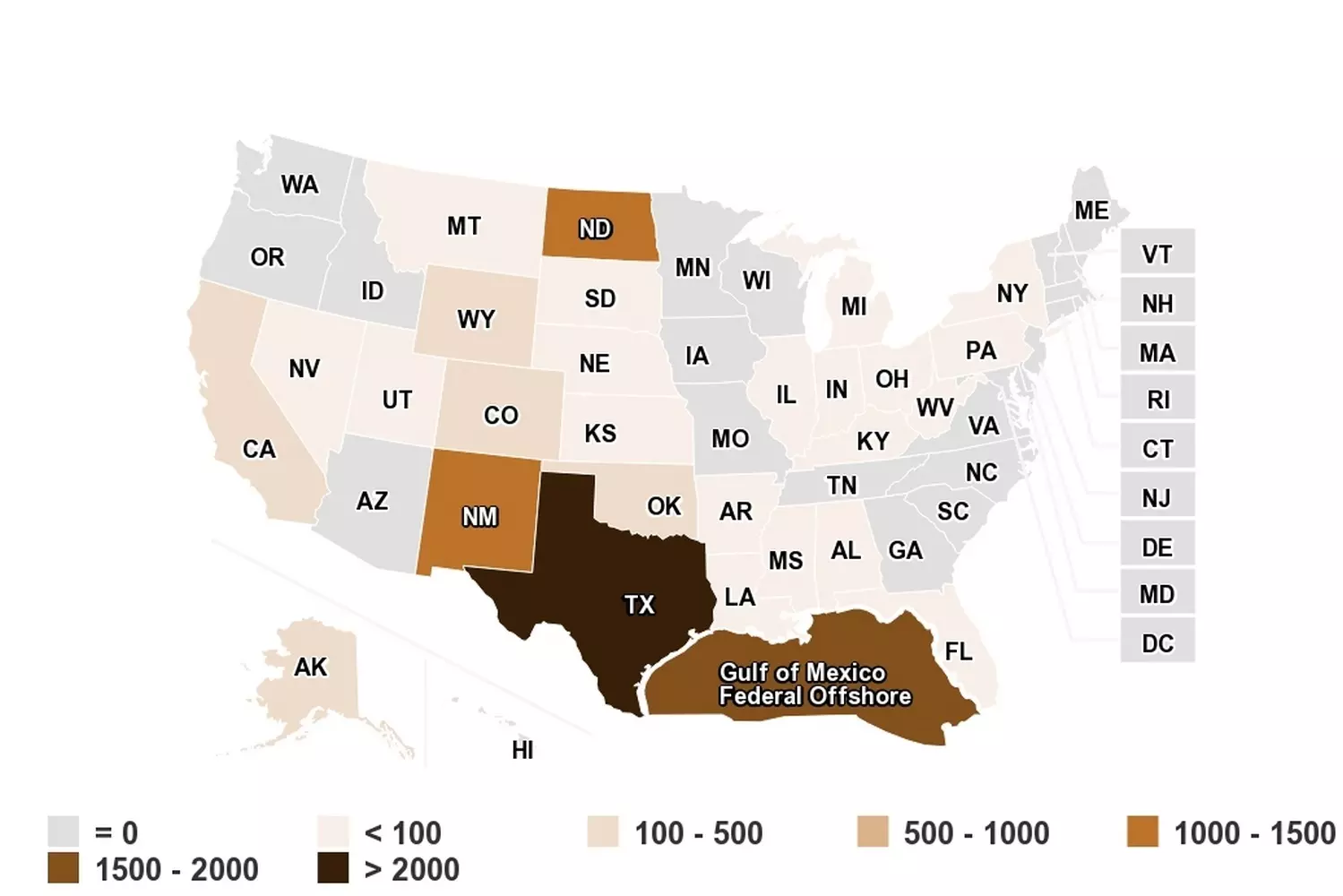

- Leading states: Texas (42%), New Mexico (13%), North Dakota (9%).

- 02. Oil Reserves

- Proven oil reserves in the USA are about 35 billion barrels.

- The USA ranks among the top 10 countries in reserves, although it trails giants like Venezuela and Saudi Arabia.

- 03. Oil Consumption

- The USA is the world’s largest oil consumer: about 19.1 million barrels per day.

- This accounts for more than 20% of global consumption despite having less than 5% of the world’s population.

- Per capita consumption is about 58 barrels per year (4 times the global average).

- 04. Import and Export

- The USA has been a net oil exporter since 2019.

- In 2023, exports averaged about 4 million barrels per day, primarily to Europe and Asia.

- Main imports are heavy crude oil from Canada (over 60% of total imports), used in refineries designed for heavy grades.

- 05. Oil Prices

- WTI prices in 2023 ranged from $65 to $90 per barrel.

- The average retail gasoline price in the USA is about $3.45 per gallon (about $0.91 per liter).

- The USA enjoys more favorable prices than Europe due to domestic production and refining capacity.

- 06. Role of Strategic Reserves

- The USA has the Strategic Petroleum Reserve (SPR) — the largest in the world, with a volume of about 370 million barrels (as of the end of 2023).

- These reserves are used during crises, hurricanes, sanctions, and market instability.

- 07. Jobs and Economic Impact

- The oil and gas industry supports more than 10.3 million jobs directly and indirectly.

- The sector accounts for about 8% of the US GDP, including petrochemicals, transportation, and refining.

Interesting fact: For every dollar invested in the oil industry, the US economy gains about $1.80 in related sectors — one of the highest multipliers among industries.

Diversity of Grades: What Types of Oil Are Produced in the USA

The USA produces dozens of oil grades, each with its own physical and chemical properties, price, and purpose. Below are the most important and iconic for the country’s oil industry.

- 01. WTI (West Texas Intermediate)

- The most famous and liquid American crude oil grade.

- Low sulfur content (sweet crude) and high lightness.

- Used as a price benchmark worldwide — alongside Brent.

- Primarily produced in Texas, Oklahoma, and New Mexico.

- Excellent for gasoline and kerosene production.

- 02. Bakken Crude

- A grade associated with the namesake shale formation in North Dakota and Montana.

- Has similar properties to WTI but less stable in supply volumes.

- Has become a key driver of the shale revolution.

- 03. Eagle Ford and Permian Light

- Two grades from the largest shale basins in Texas.

- Characterized by high density and good refining qualities.

- Main source of light oil exports from the USA.

- Permian Basin is the main growth region in the 2020s.

- 04. Alaska North Slope (ANS)

- Oil from the North Slope of Alaska.

- Heavier and more sour than WTI, requiring additional refining.

- Used mainly for the needs of the West Coast.

- 05. Mars Blend

- A heavy crude oil grade from the Gulf of Mexico shelf.

- Contains more sulfur but is in demand at US refineries configured for heavy grades.

- Often used to substitute Venezuelan and Mexican oil.

Why is this important?

- The diversity of grades gives the USA flexibility in exports and imports, allowing refining to adapt to domestic and foreign needs.

- US infrastructure (pipelines, refineries, terminals) is tailored for different grades — increasing efficiency and competitiveness.

- WTI market quotations influence fuel prices worldwide.

Interesting fact: The USA exports mainly light grades (WTI, Eagle Ford) to Europe and imports heavy crude (especially from Canada) to maintain refinery balance.

Understanding oil grades helps better grasp how the market works: from filling up your tank at home to global geopolitics. It is precisely considering such differences that the USA builds its energy security strategy.

Where America’s Oil Veins Lead: Key Production Regions

The oil landscape of the USA is the geography of giants. From the vast plains of Texas to the Arctic expanses of Alaska, from offshore platforms in the Gulf of Mexico to the windy prairies of North Dakota—each region has its own specifics, technologies, and history. Let’s take a closer look at exactly where America pumps its oil.

Interesting fact: The Permian Basin is so important that its production figures are regularly published in global economic reviews as an indicator of the state of the global market.

- 01. The Permian Basin (Texas and New Mexico) — the heart of American oil

- More than 40% of all US oil is produced here — it is the largest oil region in the country and one of the most productive in the world.

- The basin covers an area of over 220,000 sq. km and includes several geological formations: Wolfcamp, Bone Spring, and Spraberry.

- Predominantly shale light sweet crude oil is extracted here, ideal for export and gasoline production.

- Thanks to modern infrastructure and proximity to refineries, logistics is maximally efficient.

- Texas is not only oil but also a symbol of American energy: new technologies are born and tested here.

- 02. The Bakken Formation (North Dakota and Montana) — the shale star of the North

- One of the flagships of the shale revolution in the USA.

- Production began in the 1950s but saw active growth after 2006 with the introduction of horizontal drilling and fracking.

- Bakken oil is light, low in sulfur, suitable for processing on the Gulf Coast.

- The region faced infrastructure challenges due to remoteness from ports and pipelines, which led to the construction of pipelines like the Dakota Access Pipeline.

- North Dakota became one of the few states to experience population growth in recent decades—thanks to jobs in the oil industry.

- 03. Alaska (North Slope) — oil among the ice

- The most famous field is Prudhoe Bay, discovered in 1968. For a long time, it was the largest in North America.

- Production takes place in harsh climatic conditions, requiring unique technologies and year-round work in extreme environments.

- For oil transportation, the Alyeska Pipeline (Trans-Alaska Pipeline) was built — 1,287 km long from Prudhoe Bay to the port of Valdez in the south.

- Today, production in Alaska has declined compared to its peak in the 1980s, but the region remains strategically important.

- Environmental issues and preservation of the Arctic nature are especially urgent here.

- 04. The Gulf of Mexico — oil from the ocean depths

- One of the oldest offshore production regions in the world.

- Hundreds of drilling platforms — both off the coast of Louisiana and in the deep shelf.

- Offshore oil is often heavier, but its quality varies depending on the field.

- Production requires extremely complex engineering solutions due to depths, pressure, and weather conditions.

- The Gulf provides up to 15% of all US oil production.

- The region’s infrastructure is perfectly developed: ports, refineries, and export terminals are nearby.

Interesting fact: The drilling platform "Thunder Horse" off the coast of Louisiana is one of the largest in the world, capable of producing over 250,000 barrels of oil per day.

Power in Black Gold: Who Controls the U.S. Oil Industry

Unlike many oil-producing countries where the industry is wholly or partially state-owned, the U.S. oil market is an example of a free and competitive business. Here, oil is not only a natural resource but also a field for ambitious companies, investors, and innovations. Control over black gold is distributed among powerful private players, each with its own history, strategy, and influence both in the domestic market and on the global stage.

Although the market is private, the government does not leave the oil sector unattended. Federal and local authorities impose strict regulations on safety, environmental protection, taxes, and licensing. Agencies such as the Bureau of Land Management (BLM) and the Department of Energy oversee resource use on federal lands and also maintain strategic reserves.

This balance ensures the dynamic development of the industry while preventing it from overstepping legal boundaries and national interests.

Major U.S. Oil Corporations — Who Are They?

- ExxonMobil

One of the largest oil and gas companies in the world and a direct heir to John D. Rockefeller’s empire and Standard Oil. This corporation has become a symbol of America’s oil power. ExxonMobil manages gigantic fields, actively invests in new technologies and shale oil production, and holds strong positions in the global market. - Chevron

The second largest U.S. oil company. Known for its innovations in oil refining and the development of complex fields. Chevron operates not only in the U.S. but also in dozens of countries worldwide, participating in major international projects. - ConocoPhillips

A leader in shale production and one of the main drivers of the shale revolution. The company focuses on efficient horizontal drilling and fracking, maintaining high production rates, especially in Texas and North Dakota. - Occidental Petroleum

A company known for aggressive expansion, including the acquisition of major assets in the Permian Basin. Occidental actively employs innovative extraction methods and pays close attention to environmental issues. - EOG Resources and Devon Energy

Smaller but very efficient players. They specialize in developing new fields and applying advanced technologies to maximize production.

Why is private control advantageous for the U.S.?

- Flexibility and Innovation

Private companies adopt new technologies faster and adapt to market changes. - Competition and Efficiency

Competition for fields and investments stimulates process optimization and cost reduction. - Capital Attraction

Shareholder investments allow scaling projects and expanding production.

However, there are risks: oil price fluctuations strongly affect company budgets, and insufficient government control in some cases has led to environmental incidents and controversial situations.

The People Who Drive the Empire: U.S. Oil Magnates and Their Influence

Behind every oil well are not only pumps and drilling rigs but also people capable of changing the course of history. U.S. oil magnates are not just businessmen. They are architects of the energy empire, visionaries, billionaires, and players on the political stage. Their decisions affect global oil prices, exports, environmental policies, and even international conflicts.

- 01. John D. Rockefeller: The Father of American Oil

You cannot talk about oil magnates without starting with John D. Rockefeller — the man who, in the late 19th century, created Standard Oil and for the first time in history made oil a systematic industry. His company controlled up to 90% of the market, standardizing production, logistics, and refining. An interesting fact: Rockefeller’s fortune, adjusted to modern money, exceeds $400 billion.

After the 1911 antitrust breakup, giants like ExxonMobil, Chevron, and Conoco emerged from Standard Oil — the very companies that today set the industry’s rules. - 02. Darren Woods (ExxonMobil)

The CEO of the largest private oil company in the U.S. Under his leadership, Exxon focuses on shale production, development in the Permian Basin, and the synthesis of new fuel types. - 03. Mike Wirth (Chevron)

Focused on international expansion, shale technologies, and low-carbon initiatives. Chevron actively participates in carbon capture projects and the “green” transition. - 04. Henry Flagler (Standard Oil)

Co-founder of the legendary Standard Oil and John Rockefeller’s right-hand man. Flagler was responsible for the logistics and infrastructure of the oil empire in the 19th century. Later, he focused on developing Florida — building railroads, ports, and hotels, turning oil into the foundation not only of the economy but also tourism in the southern states. His name still graces streets, universities, and museums. - 05. Vicki Hollub (Occidental Petroleum)

The first female CEO of a major U.S. oil company. A leader in the shale sector and an active participant in negotiations on the industry's climate responsibility. - 06. Harold Hamm (founder of Continental Resources)

One of the pioneers of the shale revolution, a billionaire from Oklahoma. His company played a key role in developing the Bakken Formation.

U.S. oil magnates are not just wealthy individuals. They are carriers of strategic thinking, managers with global influence, and key figures in the world’s energy balance. Their actions shape not only prices and oil grades but also future policies on which the entire planet depends.

While the world debates the transition to renewable energy sources, oil magnates continue to invest in research, logistics, safety, and exports — because oil still rules the game.

How Refining and Logistics Work

Extracting oil is only the beginning. To transform raw material into gasoline, diesel, jet fuel, plastics, and thousands of other products, it must be refined, purified, separated, and transported. The United States is one of the world leaders in this technological process. Here, oil refining and logistics are not just a business but a finely tuned system perfected to excellence.

America’s Refineries: The Hearts of Black Gold

There are more than 130 major oil refineries operating across the U.S. Their combined capacity is about 18 million barrels per day. This is the largest oil refining system in the world.

- 01. Main Refining Centers

- Houston (Texas)

The largest petrochemical cluster in North America. Here are the giant refineries of ExxonMobil, Shell, Chevron. This is the “brain” of American refining, where extraction, transportation, and export converge. - Lake Charles (Louisiana)

A strategic hub for processing heavy crude from Canada and Latin America. Imported feedstock is actively used here. - Los Angeles (California)

An important refining center for oil from the Pacific Coast and Alaska. Due to environmental standards, it is one of the most modernized refineries in the country.

Interesting fact: Refineries in Texas and Louisiana process more than 50% of all U.S. oil. U.S. refineries stand out for high automation, deep processing, and export orientation. Many plants have access to seaports, which speeds up logistics and reduces costs.

- 02. What American Refineries Produce

- Gasoline, diesel, kerosene;

- Jet fuel;

- Asphalt and bitumen;

- Plastics and raw materials for the chemical industry;

- Lubricating oils and paraffins.

Refining in the U.S. is an industry employing tens of thousands, including engineers, chemists, logisticians, and automated system operators.

Oil Storage: Where America Hides Its Energy Reserves

Many imagine oil only in motion — being extracted, refined, and sold. But an equally important part of the U.S. energy infrastructure is oil storage facilities. They provide stability in crises, insure against disruptions, and offer flexibility in the global market. America not only extracts oil but also knows how to wisely stockpile and use it when needed.

- 01. What Oil Storage Facilities Are and Why They Matter

An oil storage facility is a specialized engineering structure where oil can be kept for weeks, months, or even years without losing quality. In the U.S., oil reserves are divided into commercial and strategic:

- Commercial Reserves

Stored at company sites (ExxonMobil, Chevron, etc.) to cover disruptions, seasonal demand spikes, or export commitments. - Strategic Petroleum Reserve (SPR)

A government oil stockpile controlled by the U.S. Department of Energy. Used in emergencies: wars, hurricanes, international crises.

Interesting fact: The SPR was created in 1975 following the OPEC oil embargo, which exposed U.S. vulnerability to imports.

- 02. Where the Largest Oil Storage Facilities Are Located

- Strategic Petroleum Reserve (SPR)

There are 4 facilities on the Gulf Coast (Texas and Louisiana). Capacity — 714 million barrels, but as of 2024, about 370 million barrels remain after partial releases during the energy crisis. Storage in underground salt caverns is a safe, reliable, and inexpensive method. - Cushing (Oklahoma) — “America’s Main Tank”

The most famous commercial oil storage in the U.S. Capacity — over 90 million barrels. This hub sets the price for WTI crude; futures markets are linked to it. - Other Major Hubs

- Patoka (Illinois);

- Midland (Texas);

- Beaumont and Port Arthur (Texas, Louisiana) — combine storage and refining.

- 03. What Is Stored: Grades and Strategy

The U.S. storage facilities contain different crude grades:

- WTI (West Texas Intermediate) — the core of strategic reserves and commercial trading.

- Mars Blend, Heavy Canadian Crude — heavy grades needed for deep refining.

- Sour Crude (high sulfur content) — requires specific storage and cleaning conditions.

Combined storage allows the U.S. to flexibly respond to changes in demand and logistics.

- 04. How Reserves, Imports, and Exports Are Linked

- The U.S. has been a net oil exporter since 2019.

- However, reserves are maintained to cover domestic demand spikes.

- Having stockpiles allows independence from external supplies in emergencies.

- During turbulent times, the U.S. can release oil from reserves onto the market — as happened in 2022–2023 when prices surged after geopolitical crises.

- 05. The Economics of Storage and Prices

- Storing oil is expensive. It requires infrastructure, personnel, insurance, and maintenance.

- But the benefit is clear: selling SPR oil at peak times can bring billions in revenue to the government.

- The WTI price is directly influenced by inventory levels in Cushing: the higher the inventory, the lower the price, and vice versa.

American oil storage facilities are energy insurance, a currency reserve, and a strategic asset. They allow price control, market stabilization, and faster responses to threats than other countries. Without these massive reservoirs, the U.S. would not be an energy superpower.

The ability not only to pump but also to wisely store oil transforms “black gold” into a real force underpinning the economy, politics, and everyday life for millions of Americans.

Oil Logistics: A Network Covering the Entire Continent

For oil to move from the well to the refinery, from the refinery to the gas station, and from there to the consumer, a powerful logistics system is needed. The U.S. boasts one of the most developed oil transportation networks in the world. Key elements of oil logistics include:

- Pipelines

More than 300,000 km of main and distribution pipelines. The most famous are Keystone, Dakota Access, and the Trans-Alaska Pipeline. Pipes transport both crude and finished products. - Railroads

Used to deliver oil from remote areas, especially northern territories and during peak production seasons. - Tank trucks

Essential in the final stage — delivery to gas stations, plants, and warehouses. - Maritime transport

Tanker terminals on the Gulf Coast, Pacific, and Atlantic Oceans provide export of oil and petroleum products. Ports in Texas and Louisiana are the main export gateways.

Interesting fact: Over 70% of all oil produced daily in the U.S. — more than 9 million barrels — is transported through pipelines.

The complex refining and logistics system allows the U.S. to remain one of the largest exporters of petroleum products in the world. Even if the country imports crude, it exports gasoline, diesel, and chemicals thanks to its powerful refining base.

In times of market instability, sanctions, crises, and natural disasters, the smoothness of logistics chains determines whether fuel is available at gas stations and plastic is in packaging.

Refining and logistics are the invisible gears that turn oil into economic power. And in this process, the U.S. has long held the position of global leader.

Between Progress and Nature: Oil and the Environment in the USA

In the 21st century, every industry must turn its attention to ecology, and the oil industry is no exception. The question is not whether we need oil, but how to minimize its impact on the environment. The United States is one of the few countries striving to maintain a balance between energy power and ecological responsibility.

- 01. Advantages: oil as a driver of progress

Despite criticism, it is important not to forget how much good oil has brought to the USA:

- Energy independence

Thanks to the shale revolution and high production volumes, the USA has ceased to be vulnerable to external shocks in the market. - Cheap fuel

Having its own oil keeps gasoline prices lower than in Europe or Japan. - Regional development

Oil-producing states such as Texas, North Dakota, and New Mexico have received a powerful boost to economic growth, infrastructure development, and job creation.

- 02. Disadvantages: the dark side of energy dependence

But oil also has a dark side, which is increasingly discussed among scientists, politicians, and environmentalists:

- Greenhouse gas emissions

Burning oil is one of the main sources of CO₂. This contributes to global warming and climate change. - Risk of spills

Pipelines and tankers are prone to accidents. The largest environmental disaster was the BP spill in the Gulf of Mexico in 2010, when over 4 million barrels of oil leaked into the ocean. - Pressure on ecosystems

Oil extraction disrupts natural habitats, affects populations of animals and birds, and pollutes soil and water bodies.

- 03. What America is doing: the path to ecological oil

The USA does not ignore the environmental agenda. On the contrary — it strives to modernize the industry:

- Federal regulation

The Environmental Protection Agency (EPA) implements strict emission and processing standards. - Fines and accountability

Companies are required to eliminate the consequences of spills, pay compensations, and modernize infrastructure. - Technology development

Application of carbon capture and storage (CCS), gas reinjection into reservoirs, and more environmentally friendly drilling methods. - Transition to renewables

Oil giants increasingly invest in solar, wind, and hydrogen technologies (for example, Occidental and Chevron).

The USA is one of the few countries where the green agenda is already integrated into the energy strategy at both the state and corporate levels.

- 04. Oil and the future: conflict or coexistence?

The question is not if oil will disappear, but when and how. Renewable technologies are not yet ready to replace oil in aviation, transport, and petrochemicals. But the approach to its use is changing:

- Focus on responsible extraction;

- Striving for net zero carbon footprint (Net Zero);

- Combining with “green” energy sources.

The USA has announced a goal to reduce greenhouse gas emissions by 50–52% by 2030 compared to 2005 levels. This means revising the entire chain — from the well to the gas station.

Oil is not the enemy of ecology. The enemy is unconscious and irresponsible resource use. America chooses the path of compromise: to preserve a strong energy sector while reducing harm to the planet. Will it succeed? It depends on technology, investments, and political will.

Today, oil is a litmus test of society’s maturity: we can develop it wisely or lose the chance for an ecological future.

Dark spots on the oil horizon: the biggest scandals in the history of American oil

The US oil industry is a story of success, technology, and wealth. But behind this shine lie shadows — scandals, mistakes, accidents, and corruption that have left a noticeable mark on history and society. In these stories are lessons, warnings, and sometimes challenges for the entire energy sector.

- 01. Exxon Valdez (1989) — an environmental catastrophe that shocked the world

One of the most famous oil scandals is not directly related to extraction but forever changed attitudes toward the oil industry. The Exxon Valdez tanker ran aground off the coast of Alaska, spilling about 11 million gallons of crude oil. This caused massive pollution, the death of thousands of seabirds and fish, and destruction of the ecosystem.

Although the catastrophe was due to human error, ExxonMobil faced harsh criticism for a slow response and underestimating the damage. This case spurred the tightening of environmental standards and the development of spill response technologies. - 02. The Standard Oil scandal and antitrust cases

The history of ExxonMobil — successor to Standard Oil — is closely linked to the fight against monopoly. In the early 20th century, John Rockefeller created an almost invincible oil empire controlling 90% of the US market.

In 1911, the US Supreme Court broke Standard Oil into 34 independent companies to prevent monopoly and stimulate competition. This event became a classic example of business regulation and the fight against economic concentration. - 03. Deepwater Horizon (2010) — the largest marine disaster in history

The explosion of the Deepwater Horizon platform in the Gulf of Mexico claimed 11 workers' lives and caused the largest oil spill in US history — about 4.9 million barrels. BP, the project operator, faced huge fines, lawsuits, and a damaged reputation.

The incident revealed safety control flaws, negligence, and weak offshore drilling regulation. As a result, standards were revised, but environmental and risk issues remain relevant. - 04. Price manipulation and stock market scandals

American oil companies have repeatedly been subjects of investigations for alleged price manipulation of oil and fuel. In the early 2000s, several major players were accused of collusion to artificially keep prices high, affecting consumers and the economy.

Although proving collusion is difficult, such accusations undermine trust and provoke public outrage. - 05. Corruption and lobbying

Oil companies traditionally have strong lobbying power in Washington. Sometimes this closeness to power turns into scandals related to corruption, political financing, and kickbacks. For example, a 2016 investigation uncovered illegal political campaign financing by oil corporations.

This raises questions about business influence on politics and decision-making regarding ecology, regulation, and foreign policy.

Scandals in the oil industry remind us that power and wealth come with responsibility. They show how important transparency, safety innovations, and ethical business conduct are. For consumers, this is a reason to demand honesty and environmental protection from companies and governments.

The Global Conductor with an American Accent: The Role of the USA in the World Oil Market

Today, the USA is not just a participant in the global oil market. It is a powerful player, a technological leader, a strategic partner, and a competitor all at once. Its influence extends far beyond domestic fields and national interests. The USA shapes the rules, manages market dynamics, and even balances price fluctuations, becoming the unofficial conductor of the planet’s energy orchestra.

- 01. The USA — exporter, not just consumer

The focus on the shale revolution has completely changed the world’s oil geography. Since 2019, the USA has become a net oil exporter, marking a turning point.

- Exports to Europe

Amid sanctions against Russia, the USA has become a key oil supplier to EU countries. - Supplies to Asia

China, South Korea, and Japan actively purchase American light WTI crude and petroleum products. - Supplying Latin America

Proximity and logistics make the USA an important partner for Mexico, Colombia, Chile, and other countries.

- 02. Export of technologies and influence

America exports not only oil but also know-how:

- Drilling equipment

American companies supply drilling rigs, pumps, and monitoring systems to dozens of countries. - Services and consulting

Halliburton, Schlumberger, and Baker Hughes train local personnel and build turnkey extraction systems. - Industry digitalization

Real-time monitoring platforms, AI-driven drilling optimization algorithms, environmental sensors — all originate from the USA.

Thus, US influence is felt even where there is no American oil — through technology, standards, and specialists.

- 03. America and prices: the secret arbiter of the global market

Although the official price control is held by the cartel OPEC+, it is the USA that injects flexibility and competition into the market:

- When prices rise above $70–80 per barrel, American companies increase production by bringing thousands of new wells online.

- This leads to reduced shortages and price stabilization.

- WTI crude oil futures traded in New York are among the key indicators for global traders.

More than 35% of deals in the global oil market are oriented around American price benchmarks.

Why can’t the USA be ignored on the oil stage?

- The world’s largest oil producer;

- One of the largest exporters of oil and petroleum products;

- The main source of technology in oil extraction;

- A regulator of price dynamics in the global market;

- A player combining economic strength and political influence.

America doesn’t just pump oil. It drives the market. And this trend is unlikely to change in the coming decades.

The Power of Energy: Oil in American Politics

In the United States, oil is not just an economic resource — it is a political tool. It permeates all levels of state strategy — from national security to international alliances. Every decision in Washington related to energy inevitably relies on the interests of the oil industry.

- 01. National security and energy independence

For decades, the US has aimed to reduce dependence on oil imports, especially from unstable regions. The shale revolution made this possible:

- Since 2019, the US has become a net oil exporter for the first time in 70 years.

- This has increased the autonomy of energy policy and reduced the impact of external shocks.

- The Strategic Petroleum Reserve (SPR) remains a backbone during crises, hurricanes, or military conflicts.

Oil has become part of military doctrine: ensuring reliable fuel supply for the army, navy, and air force is a matter of national security.

- 02. Middle East: oil and geopolitics

American presence in the Middle East has traditionally been linked to energy. Since the 1970s:

- The US controls the Strait of Hormuz, through which up to 20% of the world’s oil passes.

- It maintains an alliance with Saudi Arabia despite political differences — to ensure stability of supply and prices.

- Military operations in Iraq, sanctions on Iran, and control of waterways are largely driven by oil interests.

Every major American military base in the Middle East is located near key pipelines or ports.

- 03. Supporting allies through energy

The US uses oil and gas as tools of soft power:

- In 2022–2023, the US became the main supplier of LNG (liquefied natural gas) to Europe, replacing Russia.

- Oil and technology supplies help strengthen relations with Japan, South Korea, and India.

- Investments in pipelines, terminals, and energy infrastructure shape geo-economic alliances.

Energy diplomacy works more effectively than sanctions: allies value reliable and affordable supplies.

- 04. Sanctions and control over oil competitors

Oil is one of the pressure tools in the US foreign policy arsenal:

- Sanctions against Iran and Venezuela have limited their oil exports, strengthening US market positions.

- American banks and exchanges control financial flows related to oil deals.

- Through the IMF and World Bank, the US influences policies of oil-dependent developing countries.

This is not just pressure — it is building an energy architecture where the US plays a leading role.

For the US, oil is not just money and fuel. It is a lever of power, an element of strategy, and a diplomatic instrument. In every international agreement, military operation, or sanctions package, you can trace the presence of oil — as a motive, a tool, or a goal.

As long as the world depends on hydrocarbons, America will use its energy strength as a key factor of influence in global politics.

What Lies Ahead: Trends, Challenges, and Horizons

What awaits the US oil industry in the coming decades? It’s clear that the world is changing — and energy is changing with it. But oil won’t disappear overnight. Instead, we’re facing a transformation: smarter, greener, and more integrated. Let’s take a look at what “black gold” will be like tomorrow.

- 01. Production growth through technology: from barrels to bytes

American oil workers have long ceased to be just drillers. They are engineers, IT specialists, and analysts all at once:

- Artificial intelligence analyzes geological data and optimizes drilling locations.

- Drones and sensors allow real-time monitoring of leaks, pressure, and equipment wear.

- Process automation reduces accident risks and increases productivity.

Forecast: by 2030, up to 60% of new wells in the US will operate using AI and autonomous equipment.

- 02. Greening: oil without guilt and smoke

American energy is increasingly subject to sustainability requirements. The main directions are:

- Carbon capture and storage (CCS) — technologies that capture CO₂ and inject it back into underground reservoirs.

- Reducing methane leaks — a greenhouse gas more dangerous than CO₂.

- Eco-friendly drilling methods — less water usage, prevention of soil and groundwater contamination.

Oil giants such as Chevron and ExxonMobil invest billions in green projects to stay relevant in the green era.

- 03. Hybrid energy: the union of hydrocarbons and renewables

Instead of competition — synergy:

- Oil companies are building solar and wind farms to power their facilities.

- Gas and oil serve as backup sources during renewable energy interruptions.

- Hydrogen produced from natural gas with carbon capture is becoming a new direction.

According to EIA forecasts, by 2040, up to 30% of oil production facilities in the US will use hybrid energy schemes.

- 04. Refining and exporting knowledge

America wants less and less to be just a raw material supplier. Priorities include:

- Exporting finished products: gasoline, diesel, aviation fuel, plastics.

- Developing refineries: increasing processing depth and reducing harmful emissions.

- Exporting technologies and standards: from AI systems to ecological solutions for other countries.

This way, oil transforms into a value-added asset — both literally and symbolically.

America is not going to part with oil. It plans to make it smarter, cleaner, and more useful to the world. And if oil was once just fuel, today it is a driver of innovation, diplomacy, green transition, and global leadership.

Oil of the future is not just a liquid but a high-tech and politically significant asset. And the US is ready to play this game at the top level.

American Butler will show oil in action

Oil in the USA is not just fuel. It is economic power, a technological challenge, and a political tool. And until humanity fully switches to alternative energy sources, oil will continue to be pumped not only from the ground but also from world news.

If you want to see how real American energy works — embark on a tour of oil regions with American Butler, visit refining facilities, or even industrial history museums. We organize trips that reveal America without gloss, but with the power that drives the planet.